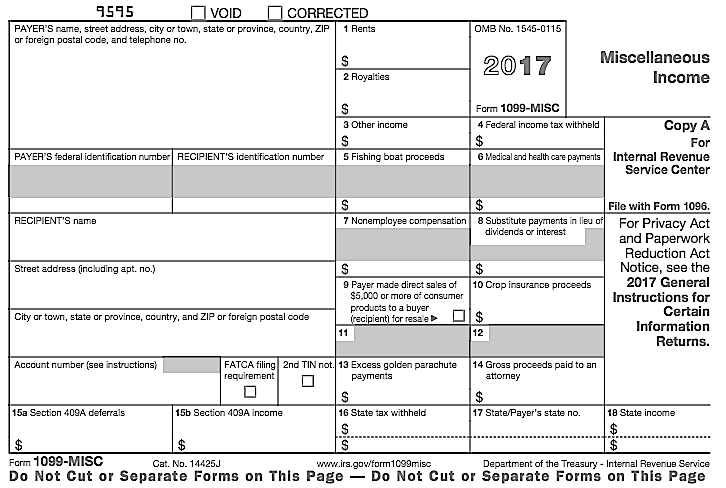

What is Form 1099-NEC? Starting with the 2020 tax year, the IRS requires businesses to use the new Form 1099-NEC to report nonemployee compensation – not Form 1099-MISC, which was previously used. Filing Taxes With a 1099-NEC If you are self-employed and receiving any type of 1099 forms, you should be using a tax preparation...

Tag: Uber Driver Tax Deductions

Tax Cuts and Jobs Act (TCJA) Made Changes to Business Deductions

As our Ken-Mar Tax clients know, we pride ourselves on maximizing tax deductions for the self-employed – which is why so many of our customers are real estate agents, small business owners and W-2ed employees with “side-hustles” like ride-sharing with Uber or Lyft, selling hand-made crafts on etsy or re-selling on Facebook Marketplace, Poshmark or...Continue reading

1099 Forms – How to File if You Get One and When You Should Be Giving Them

There are many conflicting opinions you’ll read on line and get from CPAs and tax preparation specialists about when to file a 1099 as a business and how to prepare your taxes as an individual receiving a 1099 Form. As an enrolled agent Ken Weinberg attends hours of continuing education regarding the tax code, is...Continue reading

Don’t Miss Tax Deductions for Uber, Lyft and other Ride Share Drivers

Have you recently started driving for Uber, Lyft or another ride-share company to pick up some extra cash? Unless you’ve met with Ken Weinberg of Ken-Mar Tax, you’re probably missing out on even more money in tax deductions! Being a tax reduction strategist for the self-employed, Ken specializes in helping people like you who get...Continue reading