IRS, Ohio and Local Tax Resolution:

- Free Consultations

- Stop Wage Garnishments

- Facilitate Offer In Compromise

- Set-Up Installment Agreements

- IRS Penalty Abatement

- Innocent Spouse Relief

- Ohio Tax Lien & Levy Releases

- Federal Tax Lien & Levy Releases

- Currently Non Collectible

- Back Tax Filing

- IRS Tax Relief

- Ohio Tax Relief

- RITA and CCA Tax Relief

With decades of experience in the tax industry, Ken Weinberg and the team at Ken-Mar Tax is prepared to help resolve your tax issues with our tax resolution service. Whether it's Federal Tax Resolution (from IRS back taxes or money the IRS claims you owe), Ohio State Tax Resolution (from Ohio sales tax or other state tax that Ohio claims you owe) or local tax resolution - like RITA Tax Resolution or CCA Tax Resolution. We have years of experience resolving personal back taxes, serious IRS tax issues, tax liens, tax levies, wage garnishments and collection, calls and letters. Ignoring your back taxes, unpaid taxes, misfiled taxes and penalty letters is not a step towards tax relief. Setting-up a free consultation with Ken-Mar Tax is! Let us move forward to get the IRS, State of Ohio or RITA, the CCA and other local tax collectors off your back.

Resolving IRS and Ohio Tax Penalties

Stop spending your time waiting on hold and trying to resolve tax issues on your own. Let us resolve your tax debts for you. Only three types of professionals are legally permitted to represent you - an attorney, a CPA and an Enrolled Agent (EA). As an Enrolled Agent Ken Weinberg is qualified to deal with the IRS on your behalf, and an EA is the only distinction, out of the three, that is required to go through 72 hours of specific training in how to represent clients when dealing with the IRS every 3 years, with a minimum of 16 CEs from an IRS approved provider each year.

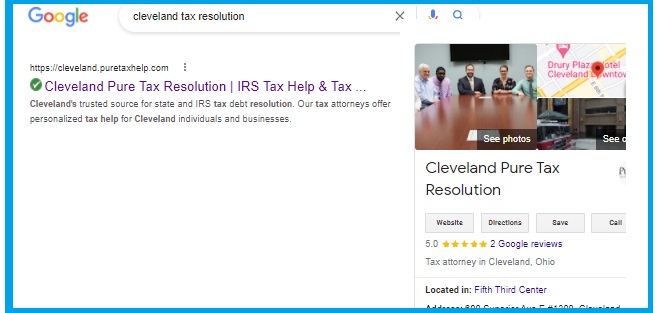

Cleveland Tax Resolution Firms

So why pay high tax attorney fees or deal with "Tax Resolution Firms" that pretend to be in Cleveland when in reality, they're a national call center*? Don't. Call Ken Weinberg at Ken-Mar Tax and schedule a free consultation to review whatever IRS and Ohio back taxes, tax liens, tax levies and tax penalties you're dealing with and let the team at Ken-Mar Tax negotiate your IRS and State of Ohio payment plans, offers in compromise and other methods of reducing your tax debt to provide tax relief.

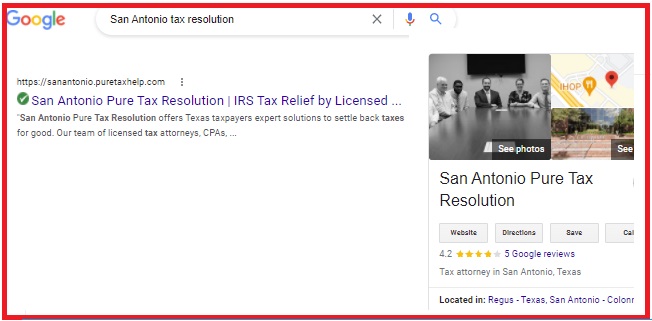

San Antonio Tax Resolution

This "Cleveland Tax Resolution" firm portrays itself as local with compelling pictures of a team in a boardroom and friendly-looking guy in his office, but it's the same images in 8 cities (Houston, Indianapolis, Michigan, Phoenix, Raleigh, Tampa, San Antonio and Dallas).

Here are two of their other websites with identical images and content to pretend they are also local to San Antonio and Tampa: Pure Tax Resolution of Cleveland , Pure Tax Resolution of Tampa and Pure Tax Resolution of San Antonio. Unfortunately, dishonesty like this only further frustrates clients who need to settle back taxes.

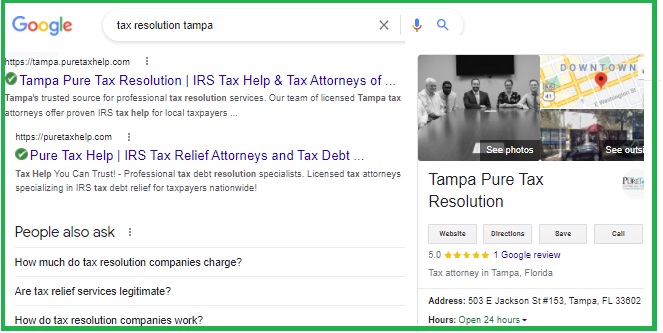

Tax Resolution Tampa

Here are two of their other websites with identical images and content to pretend they are also local to San Antonio and Tampa: Pure Tax Resolution of Cleveland , Pure Tax Resolution of Tampa and Pure Tax Resolution of San Antonio. Unfortunately, dishonesty like this only further frustrates clients who need to settle back taxes.

Here are two of their other websites with identical images and content to pretend they are also local to San Antonio and Tampa: Pure Tax Resolution of Cleveland , Pure Tax Resolution of Tampa and Pure Tax Resolution of San Antonio. Unfortunately, dishonesty like this only further frustrates clients who need to settle back taxes.

Cleveland Tax Resolution

Here are two of their other websites with identical images and content to pretend they are also local to San Antonio and Tampa: Pure Tax Resolution of Cleveland , Pure Tax Resolution of Tampa and Pure Tax Resolution of San Antonio. Unfortunately, dishonesty like this only further frustrates clients who need to settle back taxes.

*We do not aim to put-down other tax resolution companies. And we also do not have anything bad to say about other tax resolution firms. However, we do deal with many clients that have already tried working with a "Cleveland Tax Resolution Firm" only to find out they were not local. And it may not matter to everyone, but our experience is that clients will have boxes and boxes of paperwork to go through when they are catching up on back taxes and it helps to have a local company they can visit, see and explain their boxes to.

And as a real business owner in the Cleveland area (specifically North Olmsted), a Cleveland Heights High School and Cleveland State University alumni and a proud resident of North Royalton, Ohio, it's upsetting for Ken to hear many of these client nightmare stories. These fake "Cleveland Tax Resolution Firms" add the word Cleveland to their website and even o map of Ohio and pictures of Cleveland to dishonestly portray themselves as local. When digging more into their website it becomes clear this is a sales ploy designed to bring in leads – giving the frustrated, confused and vulnerable taxpayer the pretense that they’ll be able to walk into a local office and deal with an actual local professional that will help resolve their IRS, Ohio and local back tax issues.

The firms we found when doing a Google search for Cleveland Tax Resolution weren't local at all. Just Google “Tax Resolution Cleveland” and compare the results to “Tax Resolution Tampa” and "San Antonio tax resolution" you’ll see many of these firms are NOT local people despite their purposeful targeting of our Cleveland area. Please take a moment to perform some extra due diligence before engaging with a tax resolution firm that at first glance appears to be local.