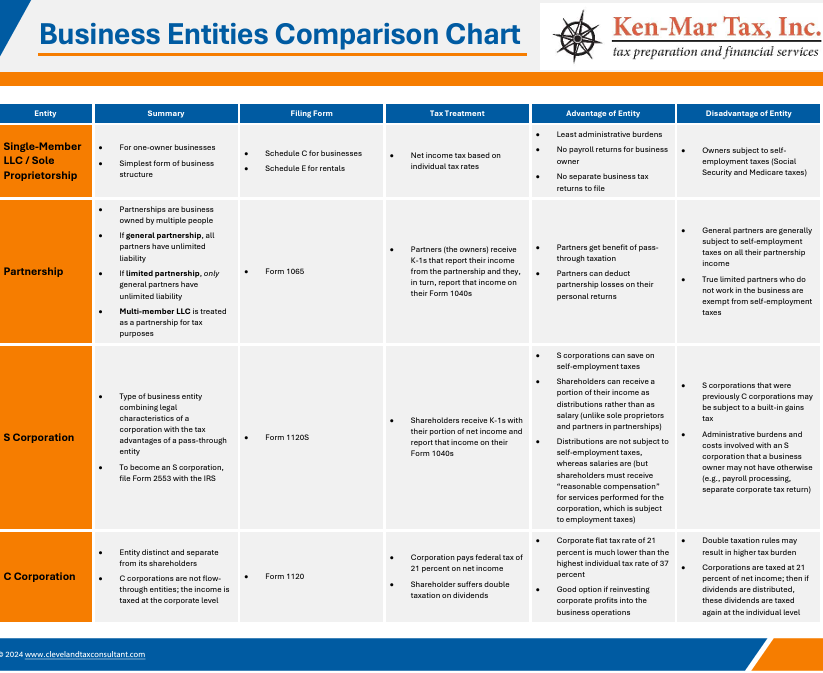

What is the Best Structure for My Business? Business Entity Chart.

What is the best structure for my business? Use this chart to help determine how best to structure your business.

Are you a business owner or entrepreneur trying to decide which entity structure is the best fit for your needs?

Navigating the complex landscape of business entities can be challenging, so we provide this Business Entity Comparison Chart to help compare advantages, disadvantages and tax implications so you can make an informed decision.

How This Business Entity Chart Can Help Your New Business:

1. It Simplifies Complex Information

1. It Simplifies Complex Information

We break down the essentials of each business entity type, including single-member LLCs, partnerships, S corporations, and C corporations, into easy-to-understand summaries that fit on one page.

2. Lists Key Features and Benefits

The chart highlights the filing forms, tax treatments, advantages, and disadvantages of each entity type, providing a balanced view that is crucial for making a strategic choice.

3. Tax Advantages and Drawbacks

From understanding the administrative burdens to recognizing the potential tax benefits and drawbacks, this chart is designed to offer practical insights that are immediately applicable to helping you determine how to structure your business scenario.

Included in the Business Entity Comparison Chart is an overview of:

Single-member LLC/Sole Proprietorship

Discover why this simplest form of business structure is favored by many solo entrepreneurs, and understand the trade-offs regarding self-employment taxes. (related posts: What Are the Tax Implications of Shutting Down a Sole Proprietorship?, Q&A: Should I Pay My Daughter by W-2 or 1099?, When Do I Have to Pay Self-Employment Taxes?)

Partnership

Learn how partnerships can benefit from pass-through taxation and the nuances of general versus limited liability within this structure. (related posts: Limited Partners and Self-Employment Taxes)

S Corporation

Find out how S corporations can save on self-employment taxes and the importance of reasonable compensation for shareholders. (related posts: IRS Doubles Down on S Corporation Reasonable Compensation, S Corporation: Common Mistakes When Converting)

C Corporation

Understand the pros and cons of a C corporation, including the flat corporate tax rate and the implications of double taxation on dividends.

Choosing the Best Structure for My Business

Choosing the right business entity can significantly impact your operational efficiency, tax obligations, and, frankly, how much money you keep in your pockets versus how much goes to the government.

Our Entity Comparison Chart is crafted to provide you with the essential knowledge to make a well-informed decision tailored to your unique business needs.

Tax Questions About Closing or Selling Your Sole Proprietorship?

As an expert in small business tax services and tax consulting Ken-Mar Tax eats, sleeps and breathes small business tax strategies. Being an enrolled agent allows founder, Ken Weinberg, to represent you to the IRS - something only a CPA, tax attorney and Enrolled Agent can do. EAs are the only federally licensed tax practitioners who specialize in taxation and also have unlimited rights to represent taxpayers before the IRS. It also means he is continuously being updated on the new IRS tax codes and taking classes from the IRS that provide guidance on how to file returns so that they are not "flagged."

When you get your taxes prepared by Ken Mar Tax you also have the option to purchase the Tax Audit Protection Plan to avoid the extra costs of paying for audit representation. If you are audited by the IRS, State of Ohio or local taxing authorities, Ken-Mar Tax will meet with the taxing authorities on your behalf to negotiate a settlement for you. The fee covers all costs up to the Appeals level, including up to 15 hours of correspondence with the auditing party – either the IRS, State of Ohio or locality.