If you gamble, take a bow and say thank you to Ronald A. Mayo, who took his gambling case to the Tax Court and won a big, precedent-setting victory for gamblers. Before getting to Mr. Mayo’s accomplishments, note that there are two types of gamblers: 1. Hobby Gamblers - those who participate in gambling for...Continue reading

Category: Tax Services Cleveland

Gambling Tax Laws

For this tax season, 2024, we have seen an increase in inquiries about gambling tax laws. With interest in writing off gambling losses, claiming gambling winnings and general questions about tax rules when it comes to gambling. See our recent posts, Can I Write Off My Gambling Losses? and When Do I Report Gambling Winnings...Continue reading

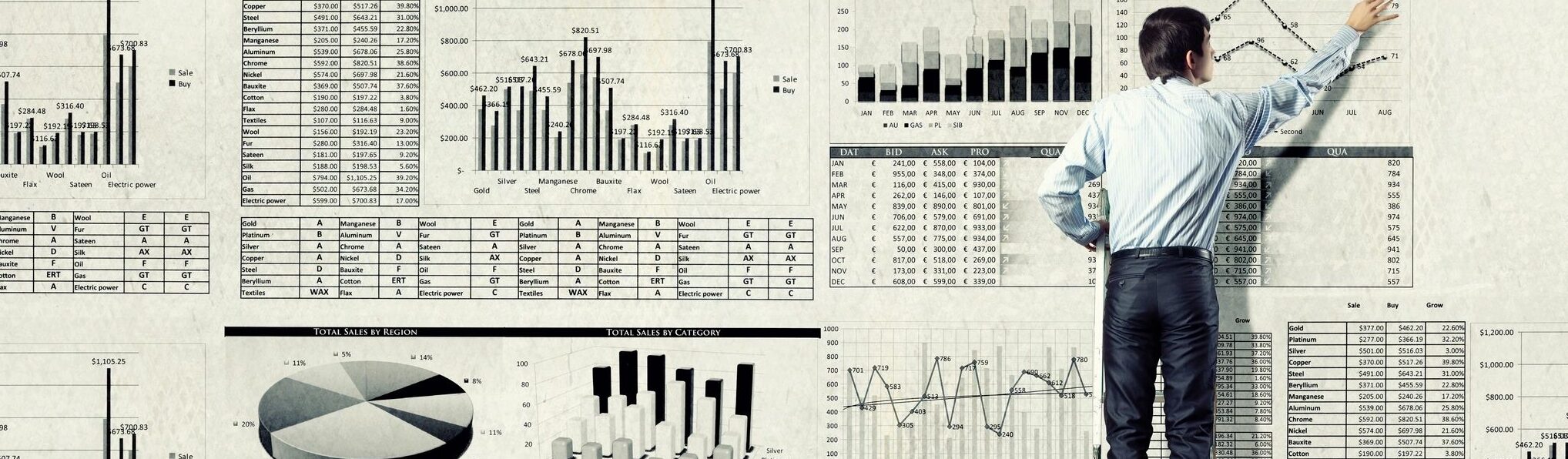

What is the Best Structure for My Business?

What is the best structure for my business? Use this chart to help determine how best to structure your business. Are you a business owner or entrepreneur trying to decide which entity structure is the best fit for your needs? Navigating the complex landscape of business entities can be challenging, so we provide this Business...Continue reading

Can I Write Off My Gambling Losses?

Ever since posting "When Do I Report Gambling Winnings to the IRS?" we have had several inquiries about writing off gambling losses. So, here's the question: "Can I write off my gambling losses?" With sports gambling legalized in Ohio since January 1, 2023, it's the 2024 tax season when this massive increase in tax questions...

BOI Reporting Deemed Unconstitutional for Some

On January 1, 2024, the Corporate Transparency Act (CTA) went into effect. The CTA requires most smaller corporations, most limited liability companies, and some other business entities to file a beneficial ownership information (BOI) report with the U.S. Department of the Treasury Financial Crimes Enforcement Network (FinCEN). The BOI report identifies and provides contact information...Continue reading

When Do I Report Gambling Winnings to the IRS?

Now that so many types of gambling are legal in Ohio, when do you have to report your gambling winnings to the IRS? If you enjoy gambling, whether occasionally or frequently, it is crucial to understand how your winnings and losses can affect your tax liability. Basic Rules to Reporting Gambling Winnings Winnings: You report...Continue reading

Do I Need to Pay Self-Employment Tax on Airbnb Rental Income?

In Chief Counsel Advice (CCA) 202151005, the IRS opined on this issue. But before we get to what the IRS said, understand that the CCA’s conclusions cannot be cited as precedent or authority by others, such as you or your tax professional. Even so, we always consider what the CCA says as semi-useful information, so here’s some...Continue reading

When Do I Have to Pay Self-Employment Taxes?

What Are Self-Employment Taxes? Do I Pay Them? Self-employment taxes are to individual business owners what payroll taxes are to employers and employees. They fund Social Security and Medicare. All individuals with self-employment income must pay self-employment taxes, regardless of their age. When business owners reach retirement age, they’ll be able to collect Social Security...Continue reading

S Corporation: Common Mistakes When Converting

Looking to convert to an S corporation? At first glance, the corporate tax rules for forming an S corp appear simple. They are not. In this article, we do two things: First, we help you avoid the potholes that destroy your S corp. Imagine what a shock that is—to find out that what you thought was...Continue reading

Home-Office Deduction: What if I Have a Pool Table in the Office?

Home-Office Deduction Question: I heard that if I had an office in my home and in that home-office room I had a pool table, I could simply subtract the amount of square footage that the pool table takes up from the square footage of the office. I do have a pool table, and I actually...Continue reading

Q&A: Should I Pay My Daughter by W-2 or 1099?

Question from a Cleveland small business owner: How do I pay my daughter? I will hire my 15-year-old daughter to work in my single-member LLC business, and I expect to pay her about $12,000 this year. Do I pay her through payroll checks and file a W-2? W-2 Payment is Important When Paying Your Daughter...Continue reading

Can RITA Garnish Your Wages? How to Eliminate Hassle and RITA Penalties

What are RITA Penalties and CCA Cleveland Collections? Are you receiving letters from organizations such as RITA and CCA? Do they threaten to apply late fees and garnished wages for taxes you’ve paid already? Are you confused, wondering how you can afford this on top of income tax? Local taxes collected by the city can be...Continue reading

Work From Home Tax Benefits in Cleveland Area

Do you live in the Cleveland area and work from home? If so, you should be aware of the many work from home tax benefits. Aside from potential home office deductions and other write-offs routinely claimed by the self-employed (see "Tax Reduction Strategies for the Self-Employed"), a huge benefit could depend on comparing the Municipal...Continue reading

2021 Last-Minute Year-End Tax Strategies for Marriage, Kids, and Family

Our specialty at Ken-Mar Tax is to provide our tax preparation clients with tax strategies that will legally reduce their tax obligations. As an IRS enrolled agent, Ken Weinberg keeps up-to-date about all the IRS tax codes in order to use them to your advantage. Tax Strategies for Getting Married, Divorced, Staying Single, Adding Your...Continue reading

2021 Last-Minute Year-End General Business Income Tax Deductions

As tax-reduction strategy specialists for the self-employed, at Ken-Mar Tax we specialize in working with local, Cleveland area, small business owners, contractors and solopreneurs. We know, at this time of year, your goal is to either eliminate, or at least reduce, the taxes you’ll owe – or better yet, get the IRS to owe you!...Continue reading

IRS Refunds Seriously Backlogged

Millions of taxpayers are still waiting for refunds and/or struggling to understand IRS notices saying their refund amounts have been adjusted. And the IRS expects to receive another 4 million returns for tax year 2020 by the October 15th tax filing extension deadline. – Forbes October 10, 2021 Why are tax refunds so late? Why...

Beginning 2020 IRS Requires 1099-NEC Instead of 1099-MISC

What is Form 1099-NEC? Starting with the 2020 tax year, the IRS requires businesses to use the new Form 1099-NEC to report nonemployee compensation – not Form 1099-MISC, which was previously used. Filing Taxes With a 1099-NEC If you are self-employed and receiving any type of 1099 forms, you should be using a tax preparation...

Tax Cuts and Jobs Act (TCJA) Made Changes to Business Deductions

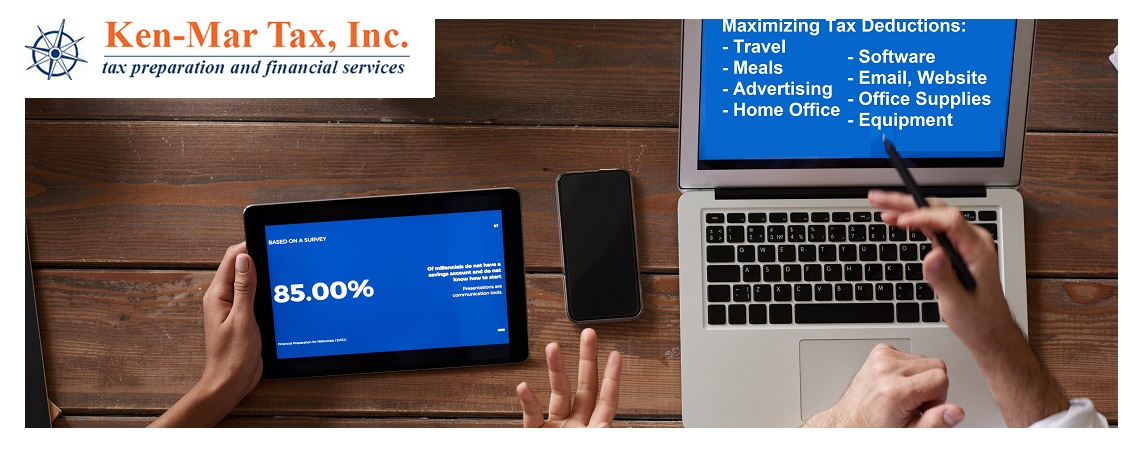

As our Ken-Mar Tax clients know, we pride ourselves on maximizing tax deductions for the self-employed – which is why so many of our customers are real estate agents, small business owners and W-2ed employees with “side-hustles” like ride-sharing with Uber or Lyft, selling hand-made crafts on etsy or re-selling on Facebook Marketplace, Poshmark or...Continue reading

IRS 5-Year Improvement Plan; Enrolled Agents or Cleveland Tax Attorneys?

Enrolled Agents of IRS Cleveland Given Details of 5-Year Plan Recently the enrolled agents of Ken-Mar Tax have been notified of the large-scale effort of the Internal Revenue Service (IRS) to increase their workforce and update their technology in order to help enforce the implementation of new tax laws. A recent article in the Government...Continue reading

File Back Taxes for Ohio Now – Tax Forgiveness

Do you owe back taxes in Ohio? Now is the time to file all Ohio back taxes and receive major savings during the Ohio Tax Amnesty period of January 1, 2018 – February 15, 2018. Whether you’re self-employed, a small business or file an individual tax return, you may apply for Ohio tax amnesty which...