For this tax season, 2024, we have seen an increase in inquiries about gambling tax laws. With interest in writing off gambling losses, claiming gambling winnings and general questions about tax rules when it comes to gambling. See our recent posts, Can I Write Off My Gambling Losses? and When Do I Report Gambling Winnings...Continue reading

Category: IRS Filing

Tax Tips for Shutting Down Your S Corporation

As you consider the process of shutting down your S corporation, it is crucial to understand the federal income tax implications that come with it. Here, I outline the tax basics for the corporation and its shareholders under two common scenarios: stock sale and asset sale with liquidation. Shutting Down Your S Corporation Scenario 1:...Continue reading

How Long Does the IRS Have to Audit Your Tax Returns?

We get many clients coming in asking about a how long the IRS can go back to audit your tax return, The good news is there is a statute of limitations on IRS audits and tax assessments. This time period is called the Assessment Statute Expiration Date (ASED). However, like all things IRS, it's more...Continue reading

IRS Dirty Dozen List: Triggers IRS Scrutiny

For over 20 years, the IRS has issued an annual Dirty Dozen list identifying tax scams and avoidance schemes. This year’s list includes everything from employee retention credit claims to the use of fake charities. Before you invest your hard-earned money in these or other highly promoted tax schemes, you should check the IRS Dirty...Continue reading

When Do I Report Gambling Winnings to the IRS?

Now that so many types of gambling are legal in Ohio, when do you have to report your gambling winnings to the IRS? If you enjoy gambling, whether occasionally or frequently, it is crucial to understand how your winnings and losses can affect your tax liability. Basic Rules to Reporting Gambling Winnings Winnings: You report...Continue reading

Last-Minute: 2023 Tax Strategies for Marriage, Kids, and Family

It's not too late to consider 2023 tax strategies. Are you thinking of getting married or divorced? If so, consider December 31, 2023, in your tax planning. Here’s another planning question: Do you give money to family or friends (other than your children, who are subject to the kiddie tax)? If so, you need to consider...Continue reading

When to File Form 8275 to Avoid Penalties

Form 8275 is filed to disclose all types of tax positions. When you're considering taking an aggressive position on your tax return that could result in a substantial tax reduction, but you're worried about having to pay a penalty, talk with Ken-Mar Tax for a free consultation. As an Enrolled Agent, Ken Weinberg is up-to-date...Continue reading

Do I Need to Pay Self-Employment Tax on Airbnb Rental Income?

In Chief Counsel Advice (CCA) 202151005, the IRS opined on this issue. But before we get to what the IRS said, understand that the CCA’s conclusions cannot be cited as precedent or authority by others, such as you or your tax professional. Even so, we always consider what the CCA says as semi-useful information, so here’s some...Continue reading

Tax Audit Penalties? How You Can Defeat The IRS

If the IRS audits you and says you owe more tax, they will often impose an accuracy-related penalty on top of the tax. This penalty is not small - at 20 percent of the additional tax owed. For a $10,000 audit assessment, that’s an additional $2,000 you have to send to Uncle Sam. In this...

When Do I Have to Pay Self-Employment Taxes?

What Are Self-Employment Taxes? Do I Pay Them? Self-employment taxes are to individual business owners what payroll taxes are to employers and employees. They fund Social Security and Medicare. All individuals with self-employment income must pay self-employment taxes, regardless of their age. When business owners reach retirement age, they’ll be able to collect Social Security...Continue reading

2021 Last-Minute Year-End Tax Strategies for Marriage, Kids, and Family

Our specialty at Ken-Mar Tax is to provide our tax preparation clients with tax strategies that will legally reduce their tax obligations. As an IRS enrolled agent, Ken Weinberg keeps up-to-date about all the IRS tax codes in order to use them to your advantage. Tax Strategies for Getting Married, Divorced, Staying Single, Adding Your...Continue reading

2021 Last-Minute Year-End General Business Income Tax Deductions

As tax-reduction strategy specialists for the self-employed, at Ken-Mar Tax we specialize in working with local, Cleveland area, small business owners, contractors and solopreneurs. We know, at this time of year, your goal is to either eliminate, or at least reduce, the taxes you’ll owe – or better yet, get the IRS to owe you!...Continue reading

IRS Refunds Seriously Backlogged

Millions of taxpayers are still waiting for refunds and/or struggling to understand IRS notices saying their refund amounts have been adjusted. And the IRS expects to receive another 4 million returns for tax year 2020 by the October 15th tax filing extension deadline. – Forbes October 10, 2021 Why are tax refunds so late? Why...

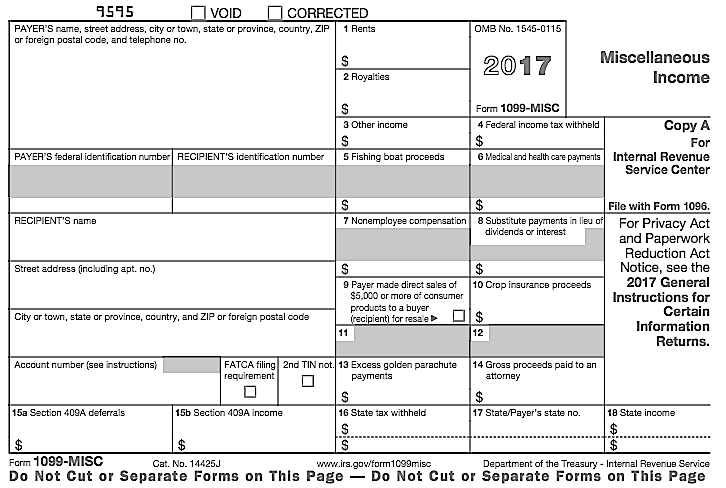

Beginning 2020 IRS Requires 1099-NEC Instead of 1099-MISC

What is Form 1099-NEC? Starting with the 2020 tax year, the IRS requires businesses to use the new Form 1099-NEC to report nonemployee compensation – not Form 1099-MISC, which was previously used. Filing Taxes With a 1099-NEC If you are self-employed and receiving any type of 1099 forms, you should be using a tax preparation...

Coronavirus Postpones Tax Deadlines & Provides IRS Collection Relief

Do you have IRS back taxes from years passed? Were you already dreading the idea of doing your 2019 taxes because of your federal tax liability? Are you in an existing installment agreement with the IRS for unpaid taxes or have a pending Offers in Compromise (OIC)? The IRS announced a new series of relief...Continue reading

IRS 5-Year Improvement Plan; Enrolled Agents or Cleveland Tax Attorneys?

Enrolled Agents of IRS Cleveland Given Details of 5-Year Plan Recently the enrolled agents of Ken-Mar Tax have been notified of the large-scale effort of the Internal Revenue Service (IRS) to increase their workforce and update their technology in order to help enforce the implementation of new tax laws. A recent article in the Government...Continue reading

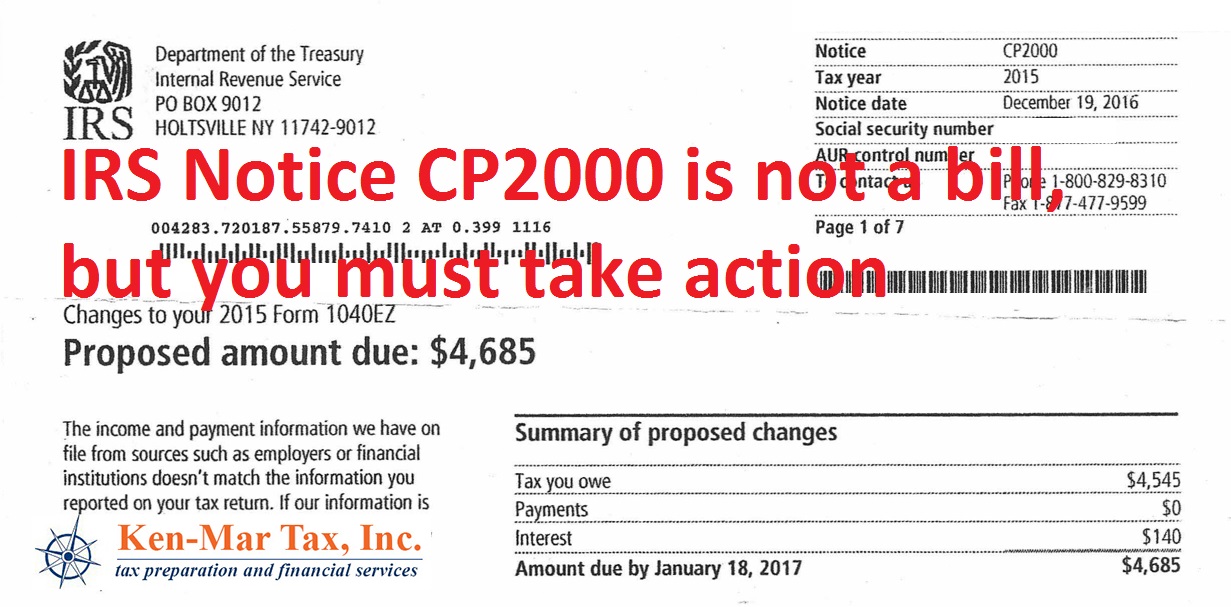

Cleveland IRS Tax Help: IRS Notice CP2000

As Cleveland tax preparation specialists we spend most of our time after “tax season” (the time period between Jan 14th and April 15th of each year) focusing on new clients that come to us with IRS, Ohio and local back taxes, tax resolution issues that can include wage garnishments and tax penalties and helping sort...Continue reading

1099 Forms – How to File if You Get One and When You Should Be Giving Them

There are many conflicting opinions you’ll read on line and get from CPAs and tax preparation specialists about when to file a 1099 as a business and how to prepare your taxes as an individual receiving a 1099 Form. As an enrolled agent Ken Weinberg attends hours of continuing education regarding the tax code, is...Continue reading

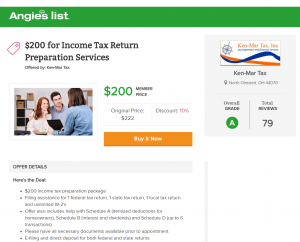

Tax Services Cleveland: Tax Preparation Coupon

Has time gotten away from you? Have you not filed your income taxes for 2016? Maybe you were too busy in January and February enjoying some of the most unseasonably warm weather for our Cleveland area. Or maybe you’re still waiting on some tax documents. Whatever the reason, the tax filing deadline this year is...Continue reading

Don’t Miss Tax Deductions for Uber, Lyft and other Ride Share Drivers

Have you recently started driving for Uber, Lyft or another ride-share company to pick up some extra cash? Unless you’ve met with Ken Weinberg of Ken-Mar Tax, you’re probably missing out on even more money in tax deductions! Being a tax reduction strategist for the self-employed, Ken specializes in helping people like you who get...Continue reading