When it comes to managing your taxes, understanding the difference between a tax accountant and a tax advisor is crucial. Both roles are essential, but they serve distinct functions that can significantly impact your financial health, especially if you’re self-employed or dealing with back taxes. Tax Accountant: The Day-to-Day Financial Gatekeeper A tax accountant is...Continue reading

Category: Cleveland IRS Tax Help

Can I Write Off My Gambling Losses?

Ever since posting "When Do I Report Gambling Winnings to the IRS?" we have had several inquiries about writing off gambling losses. So, here's the question: "Can I write off my gambling losses?" With sports gambling legalized in Ohio since January 1, 2023, it's the 2024 tax season when this massive increase in tax questions...

How Long Does the IRS Have to Audit Your Tax Returns?

We get many clients coming in asking about a how long the IRS can go back to audit your tax return, The good news is there is a statute of limitations on IRS audits and tax assessments. This time period is called the Assessment Statute Expiration Date (ASED). However, like all things IRS, it's more...Continue reading

IRS Dirty Dozen List: Triggers IRS Scrutiny

For over 20 years, the IRS has issued an annual Dirty Dozen list identifying tax scams and avoidance schemes. This year’s list includes everything from employee retention credit claims to the use of fake charities. Before you invest your hard-earned money in these or other highly promoted tax schemes, you should check the IRS Dirty...Continue reading

When Do I Report Gambling Winnings to the IRS?

Now that so many types of gambling are legal in Ohio, when do you have to report your gambling winnings to the IRS? If you enjoy gambling, whether occasionally or frequently, it is crucial to understand how your winnings and losses can affect your tax liability. Basic Rules to Reporting Gambling Winnings Winnings: You report...Continue reading

Last-Minute Purchases to Maximize 2023 Vehicle Tax Deductions

Looking to maximize your vehicle tax deductions for 2023 and wondering if there's still time? - Do you need a replacement business car, SUV, van, or pickup truck? - Do you need tax deductions this year? - Do you need a tax credit to offset what you owe to the IRS? 2023 Tax Credits /...

Last-Minute: 2023 Tax Strategies for Marriage, Kids, and Family

It's not too late to consider 2023 tax strategies. Are you thinking of getting married or divorced? If so, consider December 31, 2023, in your tax planning. Here’s another planning question: Do you give money to family or friends (other than your children, who are subject to the kiddie tax)? If so, you need to consider...Continue reading

When to File Form 8275 to Avoid Penalties

Form 8275 is filed to disclose all types of tax positions. When you're considering taking an aggressive position on your tax return that could result in a substantial tax reduction, but you're worried about having to pay a penalty, talk with Ken-Mar Tax for a free consultation. As an Enrolled Agent, Ken Weinberg is up-to-date...Continue reading

Tax Audit Penalties? How You Can Defeat The IRS

If the IRS audits you and says you owe more tax, they will often impose an accuracy-related penalty on top of the tax. This penalty is not small - at 20 percent of the additional tax owed. For a $10,000 audit assessment, that’s an additional $2,000 you have to send to Uncle Sam. In this...

When Do I Have to Pay Self-Employment Taxes?

What Are Self-Employment Taxes? Do I Pay Them? Self-employment taxes are to individual business owners what payroll taxes are to employers and employees. They fund Social Security and Medicare. All individuals with self-employment income must pay self-employment taxes, regardless of their age. When business owners reach retirement age, they’ll be able to collect Social Security...Continue reading

Back Taxes? Unfiled Tax Returns? Avoid the Tax Resolution Company.

By now you know you can't run from your back taxes and you can't hide from your back taxes, but you do not have to work with a "tax resolution firm." From our experience, most tax resolution companies are large call centers, are not local companies, charge an initial fee of $3,000-6,000 and then drag...Continue reading

Can RITA Garnish Your Wages? How to Eliminate Hassle and RITA Penalties

What are RITA Penalties and CCA Cleveland Collections? Are you receiving letters from organizations such as RITA and CCA? Do they threaten to apply late fees and garnished wages for taxes you’ve paid already? Are you confused, wondering how you can afford this on top of income tax? Local taxes collected by the city can be...Continue reading

How to Get IRS Penalties Waived?

Are you interested in learning how to get your IRS tax penalties waived? Are you wondering if the State of Ohio waives tax penalties? What about RITA, our local tax collection agency serving most of the Northeast Ohio region? If you (or your corporation) file your tax return late or fail to pay your taxes...Continue reading

Owe Back Taxes? Scary Letters from the IRS? Your Options.

What to Do If I Owe Back Taxes But I Can't Pay? You just filed your federal income tax return, looked at the amount you owed, and started to sweat because you don’t have the money. Whatever you do, ignoring your back taxes will not make it better. Even if you have several years of...Continue reading

2021 Last-Minute Year-End General Business Income Tax Deductions

As tax-reduction strategy specialists for the self-employed, at Ken-Mar Tax we specialize in working with local, Cleveland area, small business owners, contractors and solopreneurs. We know, at this time of year, your goal is to either eliminate, or at least reduce, the taxes you’ll owe – or better yet, get the IRS to owe you!...Continue reading

Coronavirus Postpones Tax Deadlines & Provides IRS Collection Relief

Do you have IRS back taxes from years passed? Were you already dreading the idea of doing your 2019 taxes because of your federal tax liability? Are you in an existing installment agreement with the IRS for unpaid taxes or have a pending Offers in Compromise (OIC)? The IRS announced a new series of relief...Continue reading

IRS 5-Year Improvement Plan; Enrolled Agents or Cleveland Tax Attorneys?

Enrolled Agents of IRS Cleveland Given Details of 5-Year Plan Recently the enrolled agents of Ken-Mar Tax have been notified of the large-scale effort of the Internal Revenue Service (IRS) to increase their workforce and update their technology in order to help enforce the implementation of new tax laws. A recent article in the Government...Continue reading

File Back Taxes for Ohio Now – Tax Forgiveness

Do you owe back taxes in Ohio? Now is the time to file all Ohio back taxes and receive major savings during the Ohio Tax Amnesty period of January 1, 2018 – February 15, 2018. Whether you’re self-employed, a small business or file an individual tax return, you may apply for Ohio tax amnesty which...

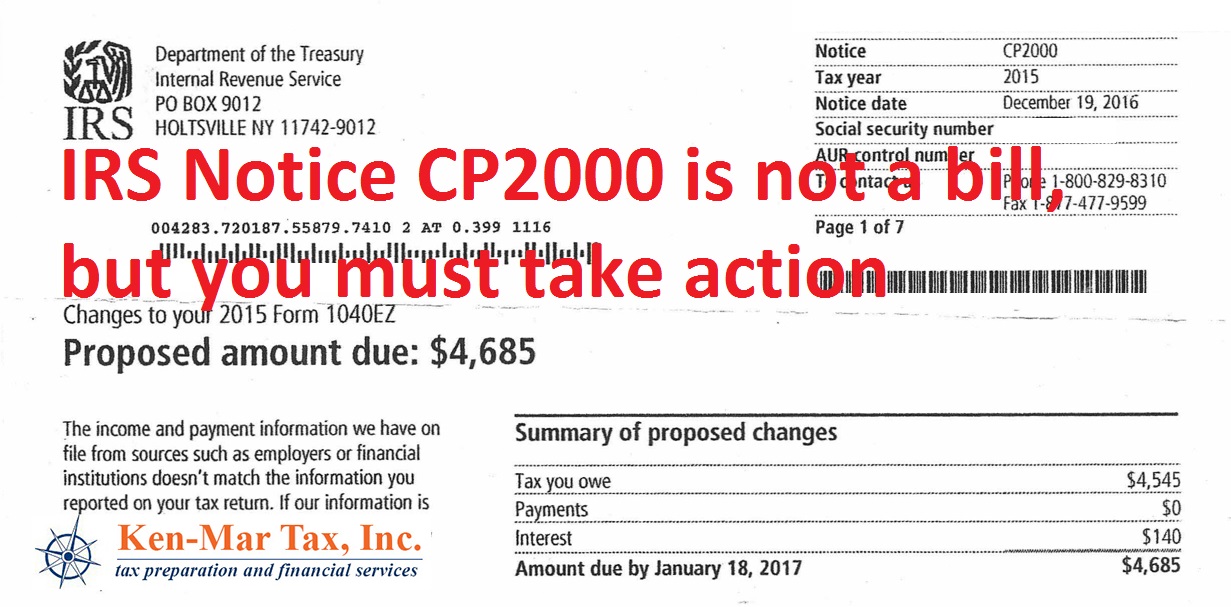

Cleveland IRS Tax Help: IRS Notice CP2000

As Cleveland tax preparation specialists we spend most of our time after “tax season” (the time period between Jan 14th and April 15th of each year) focusing on new clients that come to us with IRS, Ohio and local back taxes, tax resolution issues that can include wage garnishments and tax penalties and helping sort...Continue reading