If you gamble, take a bow and say thank you to Ronald A. Mayo, who took his gambling case to the Tax Court and won a big, precedent-setting victory for gamblers. Before getting to Mr. Mayo’s accomplishments, note that there are two types of gamblers: 1. Hobby Gamblers - those who participate in gambling for...Continue reading

Category: Tax Preparation

Gambling Tax Laws

For this tax season, 2024, we have seen an increase in inquiries about gambling tax laws. With interest in writing off gambling losses, claiming gambling winnings and general questions about tax rules when it comes to gambling. See our recent posts, Can I Write Off My Gambling Losses? and When Do I Report Gambling Winnings...Continue reading

Can I Write Off My Gambling Losses?

Ever since posting "When Do I Report Gambling Winnings to the IRS?" we have had several inquiries about writing off gambling losses. So, here's the question: "Can I write off my gambling losses?" With sports gambling legalized in Ohio since January 1, 2023, it's the 2024 tax season when this massive increase in tax questions...

IRS Delays New 1099-K Filing Rules – Again!

If you get a 1099-K you likely have a side-hustle in the gig economy or sell goods or services through a third party. When you receive payments through a third party your third-party settlement organization (TPSO) will likely issue you a 1099-K. If so, you must know the IRS’s new reporting rules. TPSOs include: payment...Continue reading

BOI Reporting Deemed Unconstitutional for Some

On January 1, 2024, the Corporate Transparency Act (CTA) went into effect. The CTA requires most smaller corporations, most limited liability companies, and some other business entities to file a beneficial ownership information (BOI) report with the U.S. Department of the Treasury Financial Crimes Enforcement Network (FinCEN). The BOI report identifies and provides contact information...Continue reading

How Long Does the IRS Have to Audit Your Tax Returns?

We get many clients coming in asking about a how long the IRS can go back to audit your tax return, The good news is there is a statute of limitations on IRS audits and tax assessments. This time period is called the Assessment Statute Expiration Date (ASED). However, like all things IRS, it's more...Continue reading

IRS Dirty Dozen List: Triggers IRS Scrutiny

For over 20 years, the IRS has issued an annual Dirty Dozen list identifying tax scams and avoidance schemes. This year’s list includes everything from employee retention credit claims to the use of fake charities. Before you invest your hard-earned money in these or other highly promoted tax schemes, you should check the IRS Dirty...Continue reading

When Do I Report Gambling Winnings to the IRS?

Now that so many types of gambling are legal in Ohio, when do you have to report your gambling winnings to the IRS? If you enjoy gambling, whether occasionally or frequently, it is crucial to understand how your winnings and losses can affect your tax liability. Basic Rules to Reporting Gambling Winnings Winnings: You report...Continue reading

Last-Minute Purchases to Maximize 2023 Vehicle Tax Deductions

Looking to maximize your vehicle tax deductions for 2023 and wondering if there's still time? - Do you need a replacement business car, SUV, van, or pickup truck? - Do you need tax deductions this year? - Do you need a tax credit to offset what you owe to the IRS? 2023 Tax Credits /...

Will Your Home Office Deduction Pass the Muster in an IRS Audit or Raise Red Flags?

With more people working from home, one has to wonder if the home-office deductions on tax returns are out of control or warranted. Will the IRS be scrutinizing home office deductions and what do they look for. In short, will your home office deduction pass in an IRS audit or will it raise red flags?...Continue reading

S Corporation: Common Mistakes When Converting

Looking to convert to an S corporation? At first glance, the corporate tax rules for forming an S corp appear simple. They are not. In this article, we do two things: First, we help you avoid the potholes that destroy your S corp. Imagine what a shock that is—to find out that what you thought was...Continue reading

Landlords and Business Owners: New Law Improves Energy Tax Benefits

Landlords and small business owners should know the newly enacted Inflation Reduction Act contains tax credits and depreciation benefits for owners of commercial property and residential rental property. As a Cleveland landlord, or small business owner, if you implement various types of renewable energy improvements, you can qualify for hefty tax credits or deductions. One...Continue reading

New Business Tax Credits for Buying Electric Vehicles

The Inflation Reduction Act of 2022 amended the Clean Vehicle Credit, and added a new requirement for final assembly in North America that took effect on August 17, 2022. Three major things to know about this new law when it relates to tax planning for your business and buying an electric vehicle: 1.The existing electric vehicle...

Q&A: Should I Pay My Daughter by W-2 or 1099?

Question from a Cleveland small business owner: How do I pay my daughter? I will hire my 15-year-old daughter to work in my single-member LLC business, and I expect to pay her about $12,000 this year. Do I pay her through payroll checks and file a W-2? W-2 Payment is Important When Paying Your Daughter...Continue reading

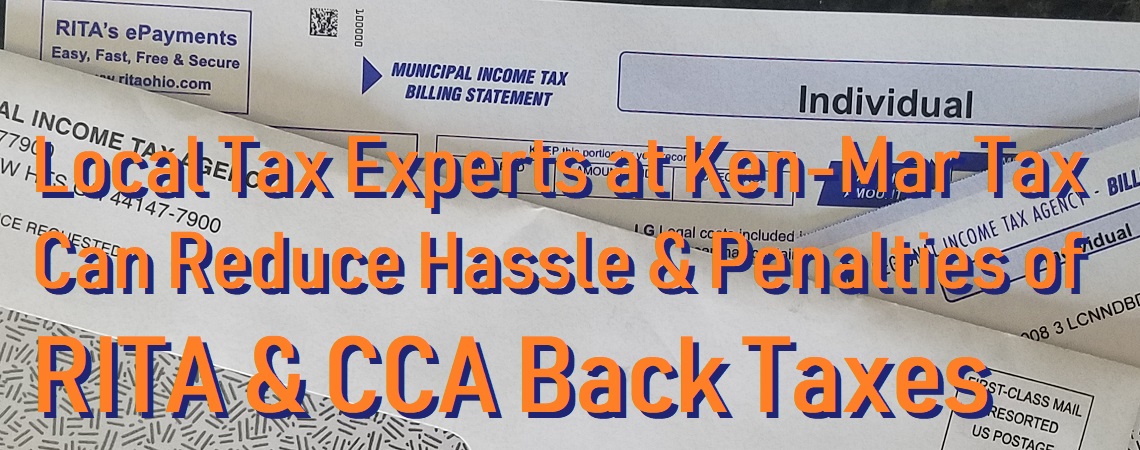

Can RITA Garnish Your Wages? How to Eliminate Hassle and RITA Penalties

What are RITA Penalties and CCA Cleveland Collections? Are you receiving letters from organizations such as RITA and CCA? Do they threaten to apply late fees and garnished wages for taxes you’ve paid already? Are you confused, wondering how you can afford this on top of income tax? Local taxes collected by the city can be...Continue reading

Don’t Forget to Request Your RITA Refund

As we posted last month in "Work From Home Tax Benefits in Cleveland Area," you may be entitled to a RITA tax refund. However, your local municipality tax collector, which is what RITA and CCA are - tax collection agencies, are waiting for you to request the refund. RITA refunds will not be automatic. CCA...Continue reading

Work From Home Tax Benefits in Cleveland Area

Do you live in the Cleveland area and work from home? If so, you should be aware of the many work from home tax benefits. Aside from potential home office deductions and other write-offs routinely claimed by the self-employed (see "Tax Reduction Strategies for the Self-Employed"), a huge benefit could depend on comparing the Municipal...Continue reading

2021 Last-Minute Year-End Tax Strategies for Marriage, Kids, and Family

Our specialty at Ken-Mar Tax is to provide our tax preparation clients with tax strategies that will legally reduce their tax obligations. As an IRS enrolled agent, Ken Weinberg keeps up-to-date about all the IRS tax codes in order to use them to your advantage. Tax Strategies for Getting Married, Divorced, Staying Single, Adding Your...Continue reading

2021 Last-Minute Year-End General Business Income Tax Deductions

As tax-reduction strategy specialists for the self-employed, at Ken-Mar Tax we specialize in working with local, Cleveland area, small business owners, contractors and solopreneurs. We know, at this time of year, your goal is to either eliminate, or at least reduce, the taxes you’ll owe – or better yet, get the IRS to owe you!...Continue reading

IRS Refunds Seriously Backlogged

Millions of taxpayers are still waiting for refunds and/or struggling to understand IRS notices saying their refund amounts have been adjusted. And the IRS expects to receive another 4 million returns for tax year 2020 by the October 15th tax filing extension deadline. – Forbes October 10, 2021 Why are tax refunds so late? Why...