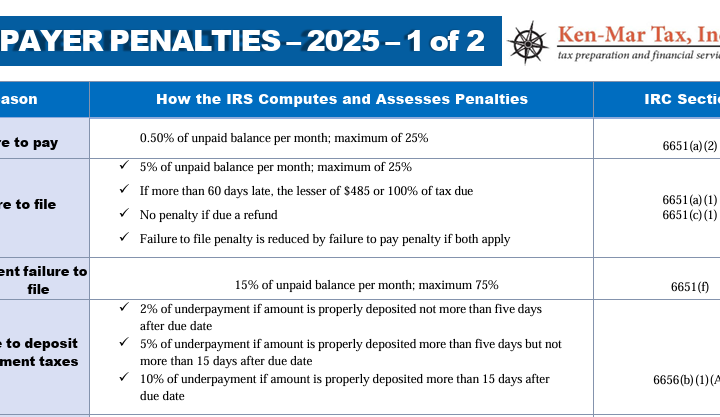

Tax season is here, and with it comes the risk 2025 IRS tax penalties that can hurt both your wallet and your peace of mind. Did you know that failing to file your tax return on time could cost you up to 25 percent of the unpaid balance? Or that underpayment of employment taxes can...

Tag: failure-to-file

Common IRS Penalties

If you’ve recently been billed by the IRS with the claim that you owe a penalty for late filing, late payment, or missed employment tax deposits, I urge you to pause before making any payment. You may not have to pay that penalty at all. The IRS often imposes steep penalties for filing tax...Continue reading