2025 Federal Tax Penalties Printable Table

Tax season is here, and with it comes the risk 2025 IRS tax penalties that can hurt both your wallet and your peace of mind.

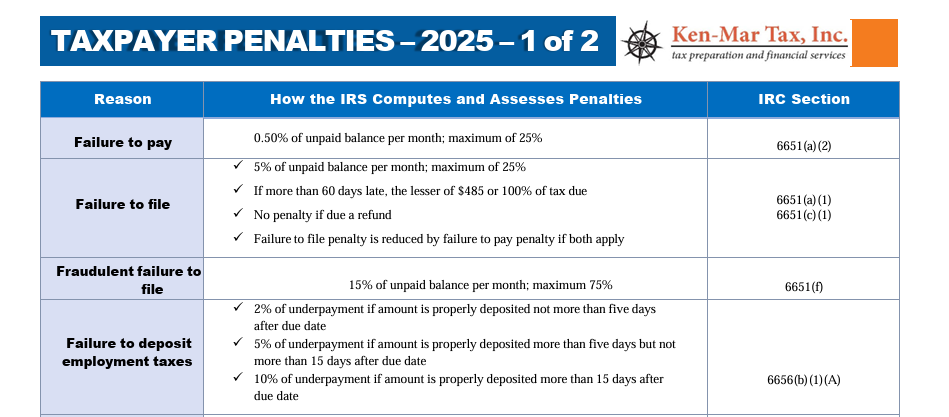

Did you know that failing to file your tax return on time could cost you up to 25 percent of the unpaid balance? Or that underpayment of employment taxes can rack up penalties of up to 10 percent?

Navigating the maze of tax rules and penalties can be overwhelming. That’s why we’ve created the ultimate resource for taxpayers: “Taxpayer Penalties – 2025”—a comprehensive desktop reference you can use to identify the reasons for penalties and how the IRS computes and assesses them.

What You’ll Find in the 2025 IRS Tax Penalties PDF

- The most common reasons taxpayers face penalties, from failure to file to accuracy-related issues

- Key details on penalty amounts, selected relief options, and relevant IRS code sections

- How to qualify for First Time Abate (FTA) relief and potentially save thousands of dollars

- Insights into employment tax deposit rules and the costly consequences of failing to comply

Why This Guide Is a Must-Have

Tax rules change every year, and staying informed is the best way to protect yourself and your business. Whether you’re an individual taxpayer or a business owner, understanding penalties can mean the difference between financial security and unexpected losses.

Click below to download your free copy of “2025 IRS Tax Penalties” and have this chart reference at your fingertips.

Related posts about tax debts:

How to Get IRS Penalties Waived?

Common IRS Penalties

Can You Go to Jail for Not Paying RITA?

Owe Back Taxes? Scary Letters from the IRS? Your Options.

Small Business Tax Services

As an expert in small business tax services and tax consulting Ken-Mar Tax eats, sleeps and breathes small business tax strategies. Being an enrolled agent allows founder, Ken Weinberg, to represent you to the IRS - something only a CPA, tax attorney and Enrolled Agent can do. EAs are the only federally licensed tax practitioners who specialize in taxation and also have unlimited rights to represent taxpayers before the IRS. It also means he is continuously being updated on the new IRS tax codes and taking classes from the IRS that provide guidance on how to file returns so that they are not "flagged."

When you get your taxes prepared by Ken Mar Tax you also have the option to purchase the Tax Audit Protection Plan to avoid the extra costs of paying for audit representation. If you are audited by the IRS, State of Ohio or local taxing authorities, Ken-Mar Tax will meet with the taxing authorities on your behalf to negotiate a settlement for you. The fee covers all costs up to the Appeals level, including up to 15 hours of correspondence with the auditing party – either the IRS, State of Ohio or locality.