If you get a 1099-K you likely have a side-hustle in the gig economy or sell goods or services through a third party. When you receive payments through a third party your third-party settlement organization (TPSO) will likely issue you a 1099-K. If so, you must know the IRS’s new reporting rules. TPSOs include: payment...Continue reading

Tag: 1099-K

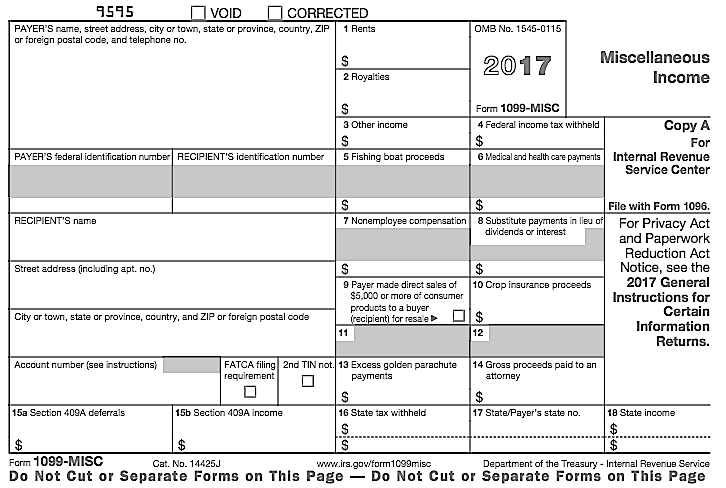

1099 Forms – How to File if You Get One and When You Should Be Giving Them

There are many conflicting opinions you’ll read on line and get from CPAs and tax preparation specialists about when to file a 1099 as a business and how to prepare your taxes as an individual receiving a 1099 Form. As an enrolled agent Ken Weinberg attends hours of continuing education regarding the tax code, is...Continue reading

Don’t Miss Tax Deductions for Uber, Lyft and other Ride Share Drivers

Have you recently started driving for Uber, Lyft or another ride-share company to pick up some extra cash? Unless you’ve met with Ken Weinberg of Ken-Mar Tax, you’re probably missing out on even more money in tax deductions! Being a tax reduction strategist for the self-employed, Ken specializes in helping people like you who get...Continue reading