Has time gotten away from you? Have you not filed your income taxes for 2016? Maybe you were too busy in January and February enjoying some of the most unseasonably warm weather for our Cleveland area. Or maybe you’re still waiting on some tax documents. Whatever the reason, the tax filing deadline this year is less than a month away; April 18th, 2017, so it’s time to get together what you have and make an appointment with Ken-Mar Tax.

Last Minute Tax Filing? This Year it Pays to Procrastinate.

Although we don’t want to encourage procrastination, we certainly can understand why it happens. Getting together your W-2s, 1099s, receipts, charitable donation information, interest deductions, and then taking the time to file your taxes and find out if you have money coming back or more money to send the IRS is not even our idea of fun (well it kind of is our idea of fun, but we know it’s not yours).

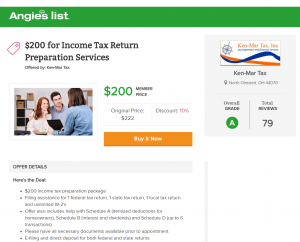

Well, lucky for you, the vast majority of our clients have already filed their taxes and now we want to make time for yours! This year, from now until April 18th, 2017, print out the coupon in this blog post, or show it to us on your smartphone and we will take 10% off your tax preparation fee. Not only are we reducing the tax prep fee, which is usually $222, we are actually offering a double-discount. With this coupon you will get 10% off our Angie’s List Special of $200 for a personal income tax preparation package that includes:

- Personal income tax filing for one federal tax return, one state tax return, one local tax return and unlimited W-2’s.

- Offer also includes tax filing help with Schedule A (itemized deductions for homeowners), Schedule B (interest and dividends) and Schedule D (up to 6 transactions).

- E-filing and direct deposit for both federal and state returns

- Please have all necessary documents available prior to appointment.

Cleveland Tax Services for the Self-Employed

Although the $200 does not include Schedules C and E and any type of self-employment income, rental income or business income you can still use the 10% Tax Preparation Coupon. The difference is that as tax reduction strategists for the self-employed we understand more than anyone that if you’re self-employed and doing your taxes the right way, your returns are like snowflakes – no two should ever look alike. So just give us a call for a quote and we’ll ask more about your business in order to anticipate how much your tax preparation fee would be, and then you’ll present the 10% off coupon to skim 10% right off the top!

Can’t Make the April 18th Deadline? Let’s File an Extension!

If you’re reading this post on April 17th and know already that there is no possible way you will be able to make the tax filing deadline of April 18th this year, don’t worry. We’ll file an extension for you – for free. Call us now, get in by the 18th to file the extension, and at least you can relax and take the time to get the paperwork in order. Plus we’ll tell you what you need and won’t need. You may be over-complicating it.

Missed the April 18th Deadline? Let’s See if we can Waive the Penalty – Sooner the Better!

Late to the party? Don’t worry. If you’re reading this after April 18th, filing an extension won’t help, and the 10% off coupon has expired. So what happens? Well you have to pay a penalty for filing late. However, at Ken-Mar Tax, because of our Enrolled Agent status and regular conversations with the IRS (we’re talking three to four times a day!) we may be able to get the late penalty fee waived. Usually the sooner we tell the IRS that the deadline has been missed, the more likely they are to waive the IRS late filing penalty. So call us now at 440-777-2207 or fill out our contact us form. We’re not like the pop-up tax filing services offered only until April by H&R Block, Liberty Tax and Jackson Hewitt at your Cleveland area mall, Sears or Wal-Mart. We are here, on Lorain Road in North Olmsted, all year round helping you with late income tax filing, back taxes, tax resolution issues and tax reduction strategies for the self-employed.

No Fields Found.