Do you owe back taxes in Ohio? Now is the time to file all Ohio back taxes and receive major savings during the Ohio Tax Amnesty period of January 1, 2018 – February 15, 2018. Whether you’re self-employed, a small business or file an individual tax return, you may apply for Ohio tax amnesty which...

Category: Individual Tax Returns

At Ken-Mar Tax we specialize in tax reduction strategies for the self-employed (think IRS Form 1099, independent contractors, realtors, small business owners, sales people that aren’t salaried – i.e. Mary Kay Cosmetics and other MLMs) as well as individual tax returns. Our team of tax professionals and Ken Weinberg, our Enrolled Agent, will occasionally post blogs with tips, advice and best practices for individual tax strategies.

If you would like to see a topic covered, have questions about maximizing your tax deductions and limiting your tax burden, or would like to set up a free tax consultation, contact us online or by calling our Cleveland area office on Lorain Rd. in N. Olmsted (almost in Fairview Park) at 440-628-1975.

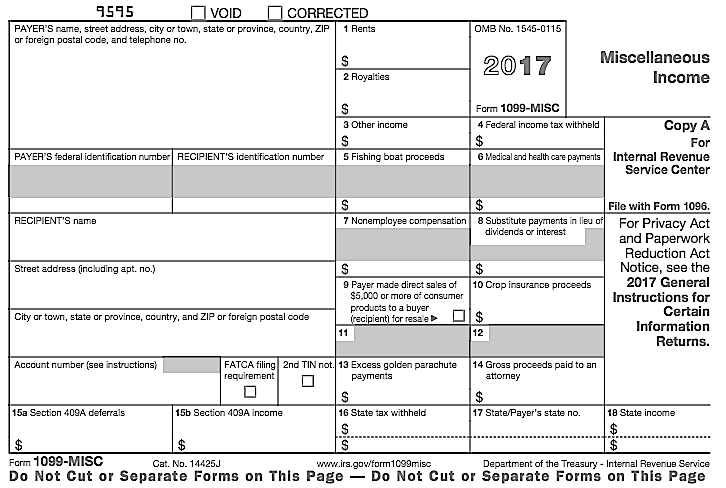

1099 Forms – How to File if You Get One and When You Should Be Giving Them

There are many conflicting opinions you’ll read on line and get from CPAs and tax preparation specialists about when to file a 1099 as a business and how to prepare your taxes as an individual receiving a 1099 Form. As an enrolled agent Ken Weinberg attends hours of continuing education regarding the tax code, is...Continue reading

Tax Services Cleveland: Tax Preparation Coupon

Has time gotten away from you? Have you not filed your income taxes for 2016? Maybe you were too busy in January and February enjoying some of the most unseasonably warm weather for our Cleveland area. Or maybe you’re still waiting on some tax documents. Whatever the reason, the tax filing deadline this year is...Continue reading

Don’t Miss Tax Deductions for Uber, Lyft and other Ride Share Drivers

Have you recently started driving for Uber, Lyft or another ride-share company to pick up some extra cash? Unless you’ve met with Ken Weinberg of Ken-Mar Tax, you’re probably missing out on even more money in tax deductions! Being a tax reduction strategist for the self-employed, Ken specializes in helping people like you who get...Continue reading

Reduce Taxable Income with these Business Expenses to Claim on Your Taxes

At Ken-Mar Tax we specialize in tax reduction strategies for the self-employed because after decades of studying the tax code, working with the IRS and preparing tax returns for self-employed individuals we realize there are still many business expenses that get forgotten when filing taxes. One thing we do to help our clients is equip...Continue reading

Tax Filing Procrastinators Welcomed at Ken-Mar Tax

We obviously advocate being proactive rather than reactive but we also understand when life, schedules, apprehension and other issues become obstacles to your tax planning. What we don’t understand is the mentality that somehow your taxes will take care of themselves. They won’t. The taxes you owe won’t pay themselves and the tax refund you...Continue reading

Ken-Mar Tax Earns Esteemed 2015 Angie’s List Super Service Award

Ken-Mar Tax is Proud to Announce Receipt of the 2015 Angie’s List Super Service Award Award reflects company’s consistently high level of customer service Ken-Mar Tax has earned the service industry’s coveted Angie’s List Super Service Award, reflecting an exemplary year of service provided to members of the local services marketplace and consumer review site in 2015....Continue reading

Tax Preparation Checklist: 5 Key Components to a Faster Tax Filing

Moving away from using TurboTax®, HR Block® or some other DIY tax software this year and getting your taxes prepared by a local Cleveland area tax professional? Good! You’ll be glad you did. Just make sure not to fall for any of these myths when choosing a tax preparation service outlined in our post “It’s...Continue reading

It’s Tax Season. Don’t Fall for these Tax Preparation Myths.

With January’s soon arrival, tax preparation advertising is sure to be in full-swing. Clearly, as tax professionals and enrolled agents for many decades, the team at Ken-Mar tax is especially irritated by the companies and marketing campaigns that project these myths to be true, so we decided it’s time to dispel some of the marketing gimmicks...Continue reading

Last-minute 2015 Tax Strategies for Individual Tax Obligations

With 2015 quickly coming to an end, did you know there is still time to implement some individual tax strategies that can reduce your tax bill? If you’re looking for a few things that can be done to impact your 2015 tax return, we’ve compiled a quick list: 1. Prepay your child’s college tuition. Prepaying college tuition...Continue reading