If you’re a self-employed contractor, consultant, or realtor who took a major business loss this year, you may be surprised to learn that you can’t always deduct the whole thing on your taxes. A rule called the Excess Business Loss Disallowance might limit how much of that loss you can write off—at least this year....Continue reading

Category: Ohio Tax Preparation

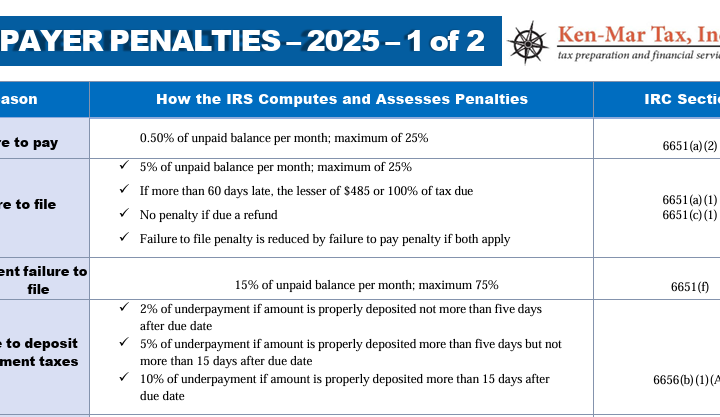

2025 IRS Tax Penalties

Tax season is here, and with it comes the risk 2025 IRS tax penalties that can hurt both your wallet and your peace of mind. Did you know that failing to file your tax return on time could cost you up to 25 percent of the unpaid balance? Or that underpayment of employment taxes can...

For Tax Purposes Are You a Real Estate Dealer or a Real Estate Investor?

If you buy and sell real estate, you need to know the difference between being classified for tax purposes as a real estate dealer versus a real estate investor. Real estate dealers are in the business of buying and selling real property—property is their inventory. Real estate investors own property primarily to earn income from...Continue reading

Maximize Your Business Vehicle Tax Deductions with Year-End 2024 Vehicle Purchases

As 2024 comes to a close, there is still time to reduce your tax liability through strategic vehicle purchases for business vehicle tax deductions. Whether you need a new SUV, pickup, van, or electric vehicle, there are significant deductions and credits available—but timing and proper planning are key. At Ken-Mar Tax, we specialize in helping...Continue reading

2024 Tax Deduction Strategies to Implement Now

As the year draws to a close, it’s the perfect time to implement 2024 tax deduction strategies that can significantly reduce your tax burden. Whether you’re a business owner or self-employed, these six powerful tax-saving tips can help you maximize your deductions and keep more of your hard-earned money. 1. Prepay Expenses to Claim Tax...Continue reading

Maximize Your Ohio Tax Refunds: What You Need to Know

If you're a business owner doing your own taxes in Ohio, you could be missing out on Ohio tax refunds. When it comes to filing your taxes in Ohio, many people leave money on the table—money that could make a big difference in their finances. Whether you're an individual taxpayer or a business owner, Ohio...Continue reading