If you're a solo business owner who prefers the benefits of a Roth retirement account—but your income is too high to contribute directly to a Roth IRA—there’s a powerful tool you should know about: the mega backdoor Roth! This strategy allows you to invest up to $70,000 ($77,500 if age 50 or older) into a...Continue reading

Category: Tax Preparation

Can You Deduct a Big Business Loss? Not So Fast…

If you’re a self-employed contractor, consultant, or realtor who took a major business loss this year, you may be surprised to learn that you can’t always deduct the whole thing on your taxes. A rule called the Excess Business Loss Disallowance might limit how much of that loss you can write off—at least this year....Continue reading

Employee or Contractor? Don’t Get It Wrong—Especially with Statutory Employees

What are statutory employees? (https://www.irs.gov/businesses/small-businesses-self-employed/statutory-employees) If you run a small business, one of the most important decisions you’ll make is how you classify your workers: are they employees or independent contractors? It’s not just a paperwork issue—it’s a tax decision with real financial consequences. If you classify a worker as an independent contractor, you don’t...Continue reading

Beat the Estimated Tax Penalty with Strategic Withholding

How can yo avoid the estimated tax penalty with strategic tax withholding? As of April 2025 — The due dates for quarterly estimated tax payments for your 2025 tax year are: April 15, 2025 June 16, 2025 September 15, 2025 January 15, 2026 If you miss one of those dates, the IRS imposes a penalty...

Combine a Home Office Tax Deduction with a Heavy Vehicle for Major Tax Write-Offs

If you are taking a home office tax deduction and considering purchasing a business vehicle, you may be eligible for significant tax deductions, especially when combining the qualifying home office. Here’s how: Heavy Vehicle Deduction In 2025, businesses can take advantage of: Section 179 expensing – Deduct up to $1,250,000 of qualifying business equipment, including...

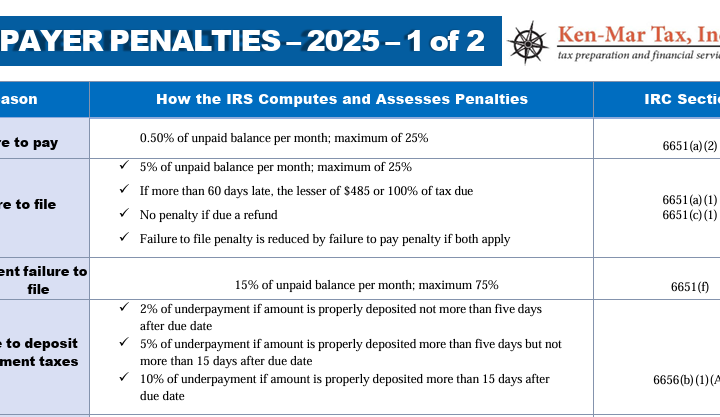

2025 IRS Tax Penalties

Tax season is here, and with it comes the risk 2025 IRS tax penalties that can hurt both your wallet and your peace of mind. Did you know that failing to file your tax return on time could cost you up to 25 percent of the unpaid balance? Or that underpayment of employment taxes can...

For Tax Purposes Are You a Real Estate Dealer or a Real Estate Investor?

If you buy and sell real estate, you need to know the difference between being classified for tax purposes as a real estate dealer versus a real estate investor. Real estate dealers are in the business of buying and selling real property—property is their inventory. Real estate investors own property primarily to earn income from...Continue reading

Avoid Losing Tax Deductions When Starting a Business

Starting a new business is an exciting endeavor, but it also comes with complex tax considerations. Starting a business for tax purposes involves more than ambition—it requires clear evidence of operational activity to justify deductions. A recent Tax Court case involving petitioners Kwaku Eason and Ashley L. Leisner highlights the importance of understanding when a...Continue reading

2024 Tax Deduction Strategies to Implement Now

As the year draws to a close, it’s the perfect time to implement 2024 tax deduction strategies that can significantly reduce your tax burden. Whether you’re a business owner or self-employed, these six powerful tax-saving tips can help you maximize your deductions and keep more of your hard-earned money. 1. Prepay Expenses to Claim Tax...Continue reading

Will You Get a Better Tax Return if You Get Married?

Many of our self-employed and small business owner clients ask us about tax implications of getting married. Marriage is a life-changing decision, and it’s essential to consider how it impacts your financial and tax situation. Depending on your circumstances, getting married could simplify your taxes—or increase your tax burden. Here are key points to keep...Continue reading

Maximize Your Ohio Tax Refunds: What You Need to Know

If you're a business owner doing your own taxes in Ohio, you could be missing out on Ohio tax refunds. When it comes to filing your taxes in Ohio, many people leave money on the table—money that could make a big difference in their finances. Whether you're an individual taxpayer or a business owner, Ohio...Continue reading

What Happens If You Don’t Pay RITA Taxes?

If you live in a municipality that works with the Regional Income Tax Agency (RITA), paying local taxes is not just a recommendation—it’s a requirement. However, life gets busy, and sometimes tax obligations fall through the cracks. But what happens if you don’t pay your RITA taxes? Understanding the consequences and the steps you can...Continue reading

Can I Deduct My Dog or Cat on My Taxes?

When we ask our clients about dependents, a common response is "that depends, can I deduct my dog." Dogs, cats, and other household pets are expensive. It costs an average of $1,270 to $2,800 a year to own a dog. Unfortunately, the expenses you incur for a family pet that provides you only with love...

1099s for Corporations and Other 1099 Surprises

You may be surprised by this headline, thinking, What? I must do 1099s for corporations? Are you kidding me? No, we’re not kidding. It’s only certain corporations, but still—this may be a shock. As you know, when your business makes payments of $600 or more from your business accounts to a person for services, you...Continue reading

Tax Accountant vs. Tax Advisor: Which One Do You Need?

When it comes to managing your taxes, understanding the difference between a tax accountant and a tax advisor is crucial. Both roles are essential, but they serve distinct functions that can significantly impact your financial health, especially if you’re self-employed or dealing with back taxes. Tax Accountant: The Day-to-Day Financial Gatekeeper A tax accountant is...Continue reading

Attention Real Estate Professionals: Are You Paying Too Much in Taxes?

If you’re a real estate professional who feels burdened by excessive taxes, it might be time to reassess your approach. Ken-Mar Tax is here to help. With over 20 years of experience, we have worked with more than 100 real estate agents across Northern Ohio, helping them optimize their tax strategies and reduce their tax...Continue reading

Tax Court Ruling to Give Professional Gamblers Tax Breaks

If you gamble, take a bow and say thank you to Ronald A. Mayo, who took his gambling case to the Tax Court and won a big, precedent-setting victory for gamblers. Before getting to Mr. Mayo’s accomplishments, note that there are two types of gamblers: 1. Hobby Gamblers - those who participate in gambling for...Continue reading

Gambling Tax Laws

For this tax season, 2024, we have seen an increase in inquiries about gambling tax laws. With interest in writing off gambling losses, claiming gambling winnings and general questions about tax rules when it comes to gambling. See our recent posts, Can I Write Off My Gambling Losses? and When Do I Report Gambling Winnings...Continue reading

Can I Write Off My Gambling Losses?

Ever since posting "When Do I Report Gambling Winnings to the IRS?" we have had several inquiries about writing off gambling losses. So, here's the question: "Can I write off my gambling losses?" With sports gambling legalized in Ohio since January 1, 2023, it's the 2024 tax season when this massive increase in tax questions...

IRS Delays New 1099-K Filing Rules – Again!

If you get a 1099-K you likely have a side-hustle in the gig economy or sell goods or services through a third party. When you receive payments through a third party your third-party settlement organization (TPSO) will likely issue you a 1099-K. If so, you must know the IRS’s new reporting rules. TPSOs include: payment...Continue reading