Form 8275 is filed to disclose all types of tax positions. When you're considering taking an aggressive position on your tax return that could result in a substantial tax reduction, but you're worried about having to pay a penalty, talk with Ken-Mar Tax for a free consultation. As an Enrolled Agent, Ken Weinberg is up-to-date...Continue reading

Category: Tax Strategies

How Do Owners of S Corporations Deduct Their Health Insurance?

An inconvenient rule applies to how S corporation owners deduct the cost of health insurance that a corporation puts on its W-2s. The words that make this an inconvenient rule are “earned income,” and this is unusual because you generally think of earned income as a good thing. But for the S corporation owner who...Continue reading

Home-Office Deductions for Orthodontists

Q&A: Home-Office Deduction for Orthodontist Question: Bob, an orthodontist, wants to claim a home-office deduction. His employees and contractors do the billing and accounting for his practice. Bob and his wife (who is an employee) do payroll once a month in the home office. Bob’s primary use of the home office is preparing treatment plans...Continue reading

Do I Need to Pay Self-Employment Tax on Airbnb Rental Income?

In Chief Counsel Advice (CCA) 202151005, the IRS opined on this issue. But before we get to what the IRS said, understand that the CCA’s conclusions cannot be cited as precedent or authority by others, such as you or your tax professional. Even so, we always consider what the CCA says as semi-useful information, so here’s some...Continue reading

What Qualifies as Regular Use for the Home-Office Deduction?

To deduct an office in the home, you must pass the regular-use test, so what is regular use for the home-office deduction? (Side note: this is a re-post of content created in 2011 and references tax cases from the 70's that laid a foundation for determining how to define "regular use" for the home office...Continue reading

Can You Deduct a Home Office if You Have Another Office Outside the Home?

Question: Can you deduct a home office if you also have a non-home office? Answer: Yes! As the tax reduction specialists for the self-employed we navigate through the home office deduction issues regularly. We know what the IRS looks for and what you will not get away with. SO let's make sure your tax reduction...Continue reading

Tax Audit Penalties? How You Can Defeat The IRS

If the IRS audits you and says you owe more tax, they will often impose an accuracy-related penalty on top of the tax. This penalty is not small - at 20 percent of the additional tax owed. For a $10,000 audit assessment, that’s an additional $2,000 you have to send to Uncle Sam. In this...

When Do I Have to Pay Self-Employment Taxes?

What Are Self-Employment Taxes? Do I Pay Them? Self-employment taxes are to individual business owners what payroll taxes are to employers and employees. They fund Social Security and Medicare. All individuals with self-employment income must pay self-employment taxes, regardless of their age. When business owners reach retirement age, they’ll be able to collect Social Security...Continue reading

S Corporation: Common Mistakes When Converting

Looking to convert to an S corporation? At first glance, the corporate tax rules for forming an S corp appear simple. They are not. In this article, we do two things: First, we help you avoid the potholes that destroy your S corp. Imagine what a shock that is—to find out that what you thought was...Continue reading

Landlords and Business Owners: New Law Improves Energy Tax Benefits

Landlords and small business owners should know the newly enacted Inflation Reduction Act contains tax credits and depreciation benefits for owners of commercial property and residential rental property. As a Cleveland landlord, or small business owner, if you implement various types of renewable energy improvements, you can qualify for hefty tax credits or deductions. One...Continue reading

Home-Office Deduction: What if I Have a Pool Table in the Office?

Home-Office Deduction Question: I heard that if I had an office in my home and in that home-office room I had a pool table, I could simply subtract the amount of square footage that the pool table takes up from the square footage of the office. I do have a pool table, and I actually...Continue reading

New Business Tax Credits for Buying Electric Vehicles

The Inflation Reduction Act of 2022 amended the Clean Vehicle Credit, and added a new requirement for final assembly in North America that took effect on August 17, 2022. Three major things to know about this new law when it relates to tax planning for your business and buying an electric vehicle: 1.The existing electric vehicle...

Q&A: Should I Pay My Daughter by W-2 or 1099?

Question from a Cleveland small business owner: How do I pay my daughter? I will hire my 15-year-old daughter to work in my single-member LLC business, and I expect to pay her about $12,000 this year. Do I pay her through payroll checks and file a W-2? W-2 Payment is Important When Paying Your Daughter...Continue reading

Don’t Forget to Request Your RITA Refund

As we posted last month in "Work From Home Tax Benefits in Cleveland Area," you may be entitled to a RITA tax refund. However, your local municipality tax collector, which is what RITA and CCA are - tax collection agencies, are waiting for you to request the refund. RITA refunds will not be automatic. CCA...Continue reading

Work From Home Tax Benefits in Cleveland Area

Do you live in the Cleveland area and work from home? If so, you should be aware of the many work from home tax benefits. Aside from potential home office deductions and other write-offs routinely claimed by the self-employed (see "Tax Reduction Strategies for the Self-Employed"), a huge benefit could depend on comparing the Municipal...Continue reading

2021 Last-Minute Year-End Tax Strategies for Marriage, Kids, and Family

Our specialty at Ken-Mar Tax is to provide our tax preparation clients with tax strategies that will legally reduce their tax obligations. As an IRS enrolled agent, Ken Weinberg keeps up-to-date about all the IRS tax codes in order to use them to your advantage. Tax Strategies for Getting Married, Divorced, Staying Single, Adding Your...Continue reading

2021 Last-Minute Year-End General Business Income Tax Deductions

As tax-reduction strategy specialists for the self-employed, at Ken-Mar Tax we specialize in working with local, Cleveland area, small business owners, contractors and solopreneurs. We know, at this time of year, your goal is to either eliminate, or at least reduce, the taxes you’ll owe – or better yet, get the IRS to owe you!...Continue reading

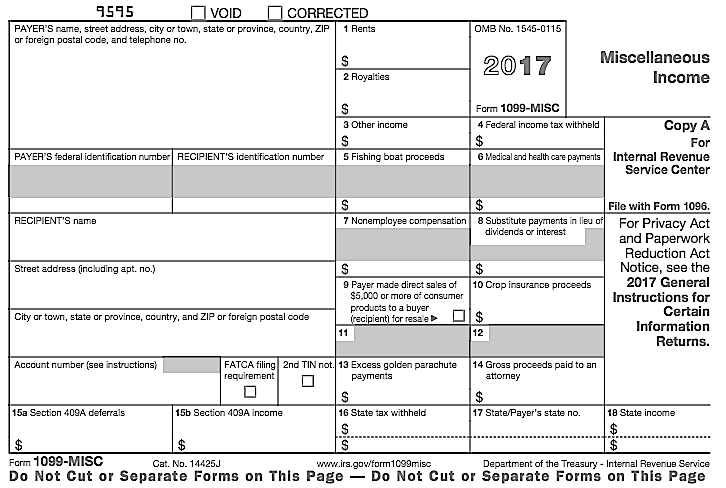

Beginning 2020 IRS Requires 1099-NEC Instead of 1099-MISC

What is Form 1099-NEC? Starting with the 2020 tax year, the IRS requires businesses to use the new Form 1099-NEC to report nonemployee compensation – not Form 1099-MISC, which was previously used. Filing Taxes With a 1099-NEC If you are self-employed and receiving any type of 1099 forms, you should be using a tax preparation...

IRS 5-Year Improvement Plan; Enrolled Agents or Cleveland Tax Attorneys?

Enrolled Agents of IRS Cleveland Given Details of 5-Year Plan Recently the enrolled agents of Ken-Mar Tax have been notified of the large-scale effort of the Internal Revenue Service (IRS) to increase their workforce and update their technology in order to help enforce the implementation of new tax laws. A recent article in the Government...Continue reading

1099 Forms – How to File if You Get One and When You Should Be Giving Them

There are many conflicting opinions you’ll read on line and get from CPAs and tax preparation specialists about when to file a 1099 as a business and how to prepare your taxes as an individual receiving a 1099 Form. As an enrolled agent Ken Weinberg attends hours of continuing education regarding the tax code, is...Continue reading