If you've fallen victim to a scam and lost money, you're probably wondering: Is scammed money tax deductible? The answer is complicated—and depends largely on why you fell for the scam. According to recent IRS guidance, your motive matters. If you were trying to make money (a profit motive), your scam-related losses may be deductible....Continue reading

Solo Business Owner with No Employees? The Mega Backdoor Roth Could Be a Game Changer

If you're a solo business owner who prefers the benefits of a Roth retirement account—but your income is too high to contribute directly to a Roth IRA—there’s a powerful tool you should know about: the mega backdoor Roth! This strategy allows you to invest up to $70,000 ($77,500 if age 50 or older) into a...Continue reading

Can You Deduct a Big Business Loss? Not So Fast…

If you’re a self-employed contractor, consultant, or realtor who took a major business loss this year, you may be surprised to learn that you can’t always deduct the whole thing on your taxes. A rule called the Excess Business Loss Disallowance might limit how much of that loss you can write off—at least this year....Continue reading

Employee or Contractor? Don’t Get It Wrong—Especially with Statutory Employees

What are statutory employees? (https://www.irs.gov/businesses/small-businesses-self-employed/statutory-employees) If you run a small business, one of the most important decisions you’ll make is how you classify your workers: are they employees or independent contractors? It’s not just a paperwork issue—it’s a tax decision with real financial consequences. If you classify a worker as an independent contractor, you don’t...Continue reading

Beat the Estimated Tax Penalty with Strategic Withholding

How can yo avoid the estimated tax penalty with strategic tax withholding? As of April 2025 — The due dates for quarterly estimated tax payments for your 2025 tax year are: April 15, 2025 June 16, 2025 September 15, 2025 January 15, 2026 If you miss one of those dates, the IRS imposes a penalty...

Corporate Transparency Act (CTA) BOI Reporting Suspended for U.S. Companies

BOI Reporting - If you have been following along with this saga you have seen us attempt to keep you updated along the way with our previous posts: BOI Report Requirements: New 2024 Businesses and Rentals (12/23), Do I Need a BOI for My LLC? Plus 12 More Answers to BOI Questions (2/24), BOI Reporting Deemed Unconstitutional...

What are the Rules for Deducting Passive Losses?

Deducting your rental property tax losses against your other income is tricky, as you likely know. You have to get the tax law to treat you—say, a computer engineer—as a tax-code–defined real estate professional. Let’s say you get there. Does that status allow immediate use of suspended passive losses? Unfortunately, the answer is no. Here’s...Continue reading

Deducting a Loss from an Airbnb Bedroom Rental

My tax professional tells me that I cannot deduct a rental loss on my Airbnb rental. She says the Morcos case limits my expenses to the amount of my rental income. My Airbnb rental is a full bedroom and bath, accessible from a separate entrance. I had the rental in place for six months during the year...Continue reading

Paying Yourself from Your Business Correctly

Paying yourself from your business depends heavily on your entity structure and understanding the tax implications of your choice. This post gives you a few key points to remember, but call us as Ken-Mar Tax for more in-depth tax advice. A common question among business owners is how to pay themselves from their businesses properly....Continue reading

Combine a Home Office Tax Deduction with a Heavy Vehicle for Major Tax Write-Offs

If you are taking a home office tax deduction and considering purchasing a business vehicle, you may be eligible for significant tax deductions, especially when combining the qualifying home office. Here’s how: Heavy Vehicle Deduction In 2025, businesses can take advantage of: Section 179 expensing – Deduct up to $1,250,000 of qualifying business equipment, including...

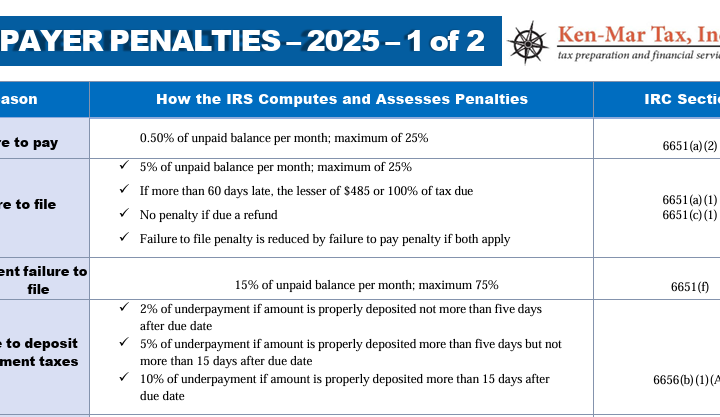

2025 IRS Tax Penalties

Tax season is here, and with it comes the risk 2025 IRS tax penalties that can hurt both your wallet and your peace of mind. Did you know that failing to file your tax return on time could cost you up to 25 percent of the unpaid balance? Or that underpayment of employment taxes can...

For Tax Purposes Are You a Real Estate Dealer or a Real Estate Investor?

If you buy and sell real estate, you need to know the difference between being classified for tax purposes as a real estate dealer versus a real estate investor. Real estate dealers are in the business of buying and selling real property—property is their inventory. Real estate investors own property primarily to earn income from...Continue reading

Avoid Losing Tax Deductions When Starting a Business

Starting a new business is an exciting endeavor, but it also comes with complex tax considerations. Starting a business for tax purposes involves more than ambition—it requires clear evidence of operational activity to justify deductions. A recent Tax Court case involving petitioners Kwaku Eason and Ashley L. Leisner highlights the importance of understanding when a...Continue reading

Maximize Your Business Vehicle Tax Deductions with Year-End 2024 Vehicle Purchases

As 2024 comes to a close, there is still time to reduce your tax liability through strategic vehicle purchases for business vehicle tax deductions. Whether you need a new SUV, pickup, van, or electric vehicle, there are significant deductions and credits available—but timing and proper planning are key. At Ken-Mar Tax, we specialize in helping...Continue reading

2024 Tax Deduction Strategies to Implement Now

As the year draws to a close, it’s the perfect time to implement 2024 tax deduction strategies that can significantly reduce your tax burden. Whether you’re a business owner or self-employed, these six powerful tax-saving tips can help you maximize your deductions and keep more of your hard-earned money. 1. Prepay Expenses to Claim Tax...Continue reading

Will You Get a Better Tax Return if You Get Married?

Many of our self-employed and small business owner clients ask us about tax implications of getting married. Marriage is a life-changing decision, and it’s essential to consider how it impacts your financial and tax situation. Depending on your circumstances, getting married could simplify your taxes—or increase your tax burden. Here are key points to keep...Continue reading

Maximize Your Ohio Tax Refunds: What You Need to Know

If you're a business owner doing your own taxes in Ohio, you could be missing out on Ohio tax refunds. When it comes to filing your taxes in Ohio, many people leave money on the table—money that could make a big difference in their finances. Whether you're an individual taxpayer or a business owner, Ohio...Continue reading

What Happens If You Don’t Pay RITA Taxes?

If you live in a municipality that works with the Regional Income Tax Agency (RITA), paying local taxes is not just a recommendation—it’s a requirement. However, life gets busy, and sometimes tax obligations fall through the cracks. But what happens if you don’t pay your RITA taxes? Understanding the consequences and the steps you can...Continue reading

Understanding Tax Representation: Cleveland Tax Attorney or an Enrolled Agent?

When it comes to navigating complex tax matters, many in the Cleveland area may assume they need to hire a Cleveland tax attorney to represent them before the IRS. However, enrolled agents (EAs) like Ken Weinberg of Ken-Mar Tax provide a highly effective—and often more affordable—alternative for tax resolution. While both tax attorneys and enrolled...Continue reading

What If I Owe the IRS and Can’t Pay?

Do you owe the IRS more than you can pay? Choosing the correct method of relief when you can’t pay your taxes can eliminate much or all of your tax debt—which can amount to thousands, even tens of thousands, of dollars—and help you get back on track financially. If your tax bill has exploded beyond...Continue reading