Does your business classify workers as independent contractors instead of employees? You should know that the U.S. Department of Labor is trying to make it harder for all businesses to use independent contractors. The Department of Labor enforces the Fair Labor Standards Act (FLSA), the federal law that requires most employers to pay employees a...Continue reading

Tag: 1099

Do I Need to Pay Self-Employment Tax on Airbnb Rental Income?

In Chief Counsel Advice (CCA) 202151005, the IRS opined on this issue. But before we get to what the IRS said, understand that the CCA’s conclusions cannot be cited as precedent or authority by others, such as you or your tax professional. Even so, we always consider what the CCA says as semi-useful information, so here’s some...Continue reading

When Do I Have to Pay Self-Employment Taxes?

What Are Self-Employment Taxes? Do I Pay Them? Self-employment taxes are to individual business owners what payroll taxes are to employers and employees. They fund Social Security and Medicare. All individuals with self-employment income must pay self-employment taxes, regardless of their age. When business owners reach retirement age, they’ll be able to collect Social Security...Continue reading

Q&A: Should I Pay My Daughter by W-2 or 1099?

Question from a Cleveland small business owner: How do I pay my daughter? I will hire my 15-year-old daughter to work in my single-member LLC business, and I expect to pay her about $12,000 this year. Do I pay her through payroll checks and file a W-2? W-2 Payment is Important When Paying Your Daughter...Continue reading

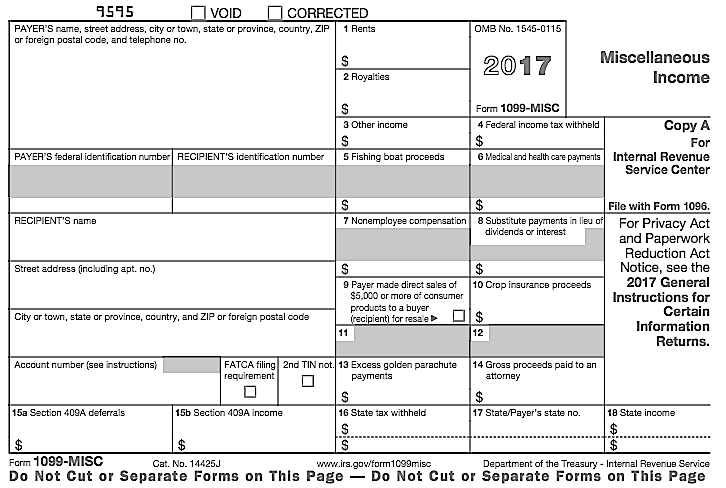

Beginning 2020 IRS Requires 1099-NEC Instead of 1099-MISC

What is Form 1099-NEC? Starting with the 2020 tax year, the IRS requires businesses to use the new Form 1099-NEC to report nonemployee compensation – not Form 1099-MISC, which was previously used. Filing Taxes With a 1099-NEC If you are self-employed and receiving any type of 1099 forms, you should be using a tax preparation...

1099 Forms – How to File if You Get One and When You Should Be Giving Them

There are many conflicting opinions you’ll read on line and get from CPAs and tax preparation specialists about when to file a 1099 as a business and how to prepare your taxes as an individual receiving a 1099 Form. As an enrolled agent Ken Weinberg attends hours of continuing education regarding the tax code, is...Continue reading

Don’t Miss Tax Deductions for Uber, Lyft and other Ride Share Drivers

Have you recently started driving for Uber, Lyft or another ride-share company to pick up some extra cash? Unless you’ve met with Ken Weinberg of Ken-Mar Tax, you’re probably missing out on even more money in tax deductions! Being a tax reduction strategist for the self-employed, Ken specializes in helping people like you who get...Continue reading