Millions of taxpayers are still waiting for refunds and/or struggling to understand IRS notices saying their refund amounts have been adjusted. And the IRS expects to receive another 4 million returns for tax year 2020 by the October 15th tax filing extension deadline. – Forbes October 10, 2021 Why are tax refunds so late? Why...

Tag: tax filing

Coronavirus Postpones Tax Deadlines & Provides IRS Collection Relief

Do you have IRS back taxes from years passed? Were you already dreading the idea of doing your 2019 taxes because of your federal tax liability? Are you in an existing installment agreement with the IRS for unpaid taxes or have a pending Offers in Compromise (OIC)? The IRS announced a new series of relief...Continue reading

File Back Taxes for Ohio Now – Tax Forgiveness

Do you owe back taxes in Ohio? Now is the time to file all Ohio back taxes and receive major savings during the Ohio Tax Amnesty period of January 1, 2018 – February 15, 2018. Whether you’re self-employed, a small business or file an individual tax return, you may apply for Ohio tax amnesty which...

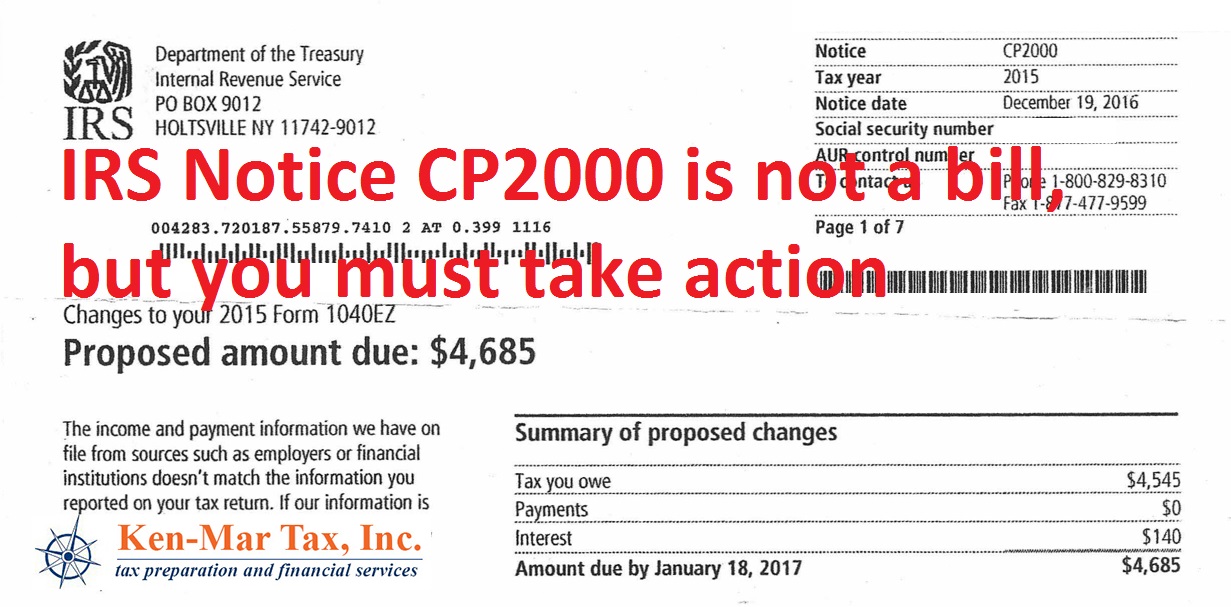

Cleveland IRS Tax Help: IRS Notice CP2000

As Cleveland tax preparation specialists we spend most of our time after “tax season” (the time period between Jan 14th and April 15th of each year) focusing on new clients that come to us with IRS, Ohio and local back taxes, tax resolution issues that can include wage garnishments and tax penalties and helping sort...Continue reading

Tax Services Cleveland: Tax Preparation Coupon

Has time gotten away from you? Have you not filed your income taxes for 2016? Maybe you were too busy in January and February enjoying some of the most unseasonably warm weather for our Cleveland area. Or maybe you’re still waiting on some tax documents. Whatever the reason, the tax filing deadline this year is...Continue reading

Reduce Taxable Income with these Business Expenses to Claim on Your Taxes

At Ken-Mar Tax we specialize in tax reduction strategies for the self-employed because after decades of studying the tax code, working with the IRS and preparing tax returns for self-employed individuals we realize there are still many business expenses that get forgotten when filing taxes. One thing we do to help our clients is equip...Continue reading

Tax Filing Procrastinators Welcomed at Ken-Mar Tax

We obviously advocate being proactive rather than reactive but we also understand when life, schedules, apprehension and other issues become obstacles to your tax planning. What we don’t understand is the mentality that somehow your taxes will take care of themselves. They won’t. The taxes you owe won’t pay themselves and the tax refund you...Continue reading

Tax Preparation Checklist: 5 Key Components to a Faster Tax Filing

Moving away from using TurboTax®, HR Block® or some other DIY tax software this year and getting your taxes prepared by a local Cleveland area tax professional? Good! You’ll be glad you did. Just make sure not to fall for any of these myths when choosing a tax preparation service outlined in our post “It’s...Continue reading

It’s Tax Season. Don’t Fall for these Tax Preparation Myths.

With January’s soon arrival, tax preparation advertising is sure to be in full-swing. Clearly, as tax professionals and enrolled agents for many decades, the team at Ken-Mar tax is especially irritated by the companies and marketing campaigns that project these myths to be true, so we decided it’s time to dispel some of the marketing gimmicks...Continue reading

Last-minute 2015 Tax Strategies for Individual Tax Obligations

With 2015 quickly coming to an end, did you know there is still time to implement some individual tax strategies that can reduce your tax bill? If you’re looking for a few things that can be done to impact your 2015 tax return, we’ve compiled a quick list: 1. Prepay your child’s college tuition. Prepaying college tuition...Continue reading