Deducting your rental property tax losses against your other income is tricky, as you likely know. You have to get the tax law to treat you—say, a computer engineer—as a tax-code–defined real estate professional. Let’s say you get there. Does that status allow immediate use of suspended passive losses? Unfortunately, the answer is no. Here’s...Continue reading

Tag: tax preparation

Avoid Losing Tax Deductions When Starting a Business

Starting a new business is an exciting endeavor, but it also comes with complex tax considerations. Starting a business for tax purposes involves more than ambition—it requires clear evidence of operational activity to justify deductions. A recent Tax Court case involving petitioners Kwaku Eason and Ashley L. Leisner highlights the importance of understanding when a...Continue reading

Tax Court Ruling to Give Professional Gamblers Tax Breaks

If you gamble, take a bow and say thank you to Ronald A. Mayo, who took his gambling case to the Tax Court and won a big, precedent-setting victory for gamblers. Before getting to Mr. Mayo’s accomplishments, note that there are two types of gamblers: 1. Hobby Gamblers - those who participate in gambling for...Continue reading

Home-Office Deductions for Orthodontists

Q&A: Home-Office Deduction for Orthodontist Question: Bob, an orthodontist, wants to claim a home-office deduction. His employees and contractors do the billing and accounting for his practice. Bob and his wife (who is an employee) do payroll once a month in the home office. Bob’s primary use of the home office is preparing treatment plans...Continue reading

Tax Audit Penalties? How You Can Defeat The IRS

If the IRS audits you and says you owe more tax, they will often impose an accuracy-related penalty on top of the tax. This penalty is not small - at 20 percent of the additional tax owed. For a $10,000 audit assessment, that’s an additional $2,000 you have to send to Uncle Sam. In this...

Don’t Forget to Request Your RITA Refund

As we posted last month in "Work From Home Tax Benefits in Cleveland Area," you may be entitled to a RITA tax refund. However, your local municipality tax collector, which is what RITA and CCA are - tax collection agencies, are waiting for you to request the refund. RITA refunds will not be automatic. CCA...Continue reading

IRS Refunds Seriously Backlogged

Millions of taxpayers are still waiting for refunds and/or struggling to understand IRS notices saying their refund amounts have been adjusted. And the IRS expects to receive another 4 million returns for tax year 2020 by the October 15th tax filing extension deadline. – Forbes October 10, 2021 Why are tax refunds so late? Why...

Coronavirus Postpones Tax Deadlines & Provides IRS Collection Relief

Do you have IRS back taxes from years passed? Were you already dreading the idea of doing your 2019 taxes because of your federal tax liability? Are you in an existing installment agreement with the IRS for unpaid taxes or have a pending Offers in Compromise (OIC)? The IRS announced a new series of relief...Continue reading

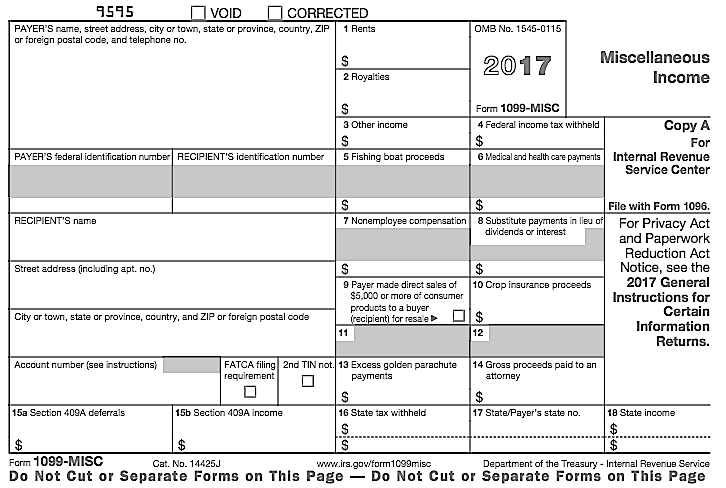

1099 Forms – How to File if You Get One and When You Should Be Giving Them

There are many conflicting opinions you’ll read on line and get from CPAs and tax preparation specialists about when to file a 1099 as a business and how to prepare your taxes as an individual receiving a 1099 Form. As an enrolled agent Ken Weinberg attends hours of continuing education regarding the tax code, is...Continue reading

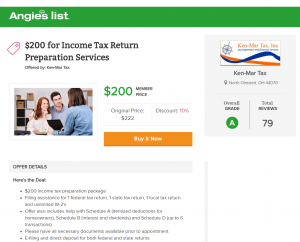

Tax Services Cleveland: Tax Preparation Coupon

Has time gotten away from you? Have you not filed your income taxes for 2016? Maybe you were too busy in January and February enjoying some of the most unseasonably warm weather for our Cleveland area. Or maybe you’re still waiting on some tax documents. Whatever the reason, the tax filing deadline this year is...Continue reading

Don’t Miss Tax Deductions for Uber, Lyft and other Ride Share Drivers

Have you recently started driving for Uber, Lyft or another ride-share company to pick up some extra cash? Unless you’ve met with Ken Weinberg of Ken-Mar Tax, you’re probably missing out on even more money in tax deductions! Being a tax reduction strategist for the self-employed, Ken specializes in helping people like you who get...Continue reading

Tax Filing Procrastinators Welcomed at Ken-Mar Tax

We obviously advocate being proactive rather than reactive but we also understand when life, schedules, apprehension and other issues become obstacles to your tax planning. What we don’t understand is the mentality that somehow your taxes will take care of themselves. They won’t. The taxes you owe won’t pay themselves and the tax refund you...Continue reading

Ken-Mar Tax Earns Esteemed 2015 Angie’s List Super Service Award

Ken-Mar Tax is Proud to Announce Receipt of the 2015 Angie’s List Super Service Award Award reflects company’s consistently high level of customer service Ken-Mar Tax has earned the service industry’s coveted Angie’s List Super Service Award, reflecting an exemplary year of service provided to members of the local services marketplace and consumer review site in 2015....Continue reading

It’s Tax Season. Don’t Fall for these Tax Preparation Myths.

With January’s soon arrival, tax preparation advertising is sure to be in full-swing. Clearly, as tax professionals and enrolled agents for many decades, the team at Ken-Mar tax is especially irritated by the companies and marketing campaigns that project these myths to be true, so we decided it’s time to dispel some of the marketing gimmicks...Continue reading

Last-minute 2015 Tax Strategies for Individual Tax Obligations

With 2015 quickly coming to an end, did you know there is still time to implement some individual tax strategies that can reduce your tax bill? If you’re looking for a few things that can be done to impact your 2015 tax return, we’ve compiled a quick list: 1. Prepay your child’s college tuition. Prepaying college tuition...Continue reading