Now that so many types of gambling are legal in Ohio, when do you have to report your gambling winnings to the IRS? If you enjoy gambling, whether occasionally or frequently, it is crucial to understand how your winnings and losses can affect your tax liability. Basic Rules to Reporting Gambling Winnings Winnings: You report...Continue reading

Category: Tax Services Cleveland

Do I Need to Pay Self-Employment Tax on Airbnb Rental Income?

In Chief Counsel Advice (CCA) 202151005, the IRS opined on this issue. But before we get to what the IRS said, understand that the CCA’s conclusions cannot be cited as precedent or authority by others, such as you or your tax professional. Even so, we always consider what the CCA says as semi-useful information, so here’s some...Continue reading

When Do I Have to Pay Self-Employment Taxes?

What Are Self-Employment Taxes? Do I Pay Them? Self-employment taxes are to individual business owners what payroll taxes are to employers and employees. They fund Social Security and Medicare. All individuals with self-employment income must pay self-employment taxes, regardless of their age. When business owners reach retirement age, they’ll be able to collect Social Security...Continue reading

S Corporation: Common Mistakes When Converting

Looking to convert to an S corporation? At first glance, the corporate tax rules for forming an S corp appear simple. They are not. In this article, we do two things: First, we help you avoid the potholes that destroy your S corp. Imagine what a shock that is—to find out that what you thought was...Continue reading

Home-Office Deduction: What if I Have a Pool Table in the Office?

Home-Office Deduction Question: I heard that if I had an office in my home and in that home-office room I had a pool table, I could simply subtract the amount of square footage that the pool table takes up from the square footage of the office. I do have a pool table, and I actually...Continue reading

Q&A: Should I Pay My Daughter by W-2 or 1099?

Question from a Cleveland small business owner: How do I pay my daughter? I will hire my 15-year-old daughter to work in my single-member LLC business, and I expect to pay her about $12,000 this year. Do I pay her through payroll checks and file a W-2? W-2 Payment is Important When Paying Your Daughter...Continue reading

Can RITA Garnish Your Wages? How to Eliminate Hassle and RITA Penalties

What are RITA Penalties and CCA Cleveland Collections? Are you receiving letters from organizations such as RITA and CCA? Do they threaten to apply late fees and garnished wages for taxes you’ve paid already? Are you confused, wondering how you can afford this on top of income tax? Local taxes collected by the city can be...Continue reading

Work From Home Tax Benefits in Cleveland Area

Do you live in the Cleveland area and work from home? If so, you should be aware of the many work from home tax benefits. Aside from potential home office deductions and other write-offs routinely claimed by the self-employed (see "Tax Reduction Strategies for the Self-Employed"), a huge benefit could depend on comparing the Municipal...Continue reading

2021 Last-Minute Year-End Tax Strategies for Marriage, Kids, and Family

Our specialty at Ken-Mar Tax is to provide our tax preparation clients with tax strategies that will legally reduce their tax obligations. As an IRS enrolled agent, Ken Weinberg keeps up-to-date about all the IRS tax codes in order to use them to your advantage. Tax Strategies for Getting Married, Divorced, Staying Single, Adding Your...Continue reading

2021 Last-Minute Year-End General Business Income Tax Deductions

As tax-reduction strategy specialists for the self-employed, at Ken-Mar Tax we specialize in working with local, Cleveland area, small business owners, contractors and solopreneurs. We know, at this time of year, your goal is to either eliminate, or at least reduce, the taxes you’ll owe – or better yet, get the IRS to owe you!...Continue reading

IRS Refunds Seriously Backlogged

Millions of taxpayers are still waiting for refunds and/or struggling to understand IRS notices saying their refund amounts have been adjusted. And the IRS expects to receive another 4 million returns for tax year 2020 by the October 15th tax filing extension deadline. – Forbes October 10, 2021 Why are tax refunds so late? Why...

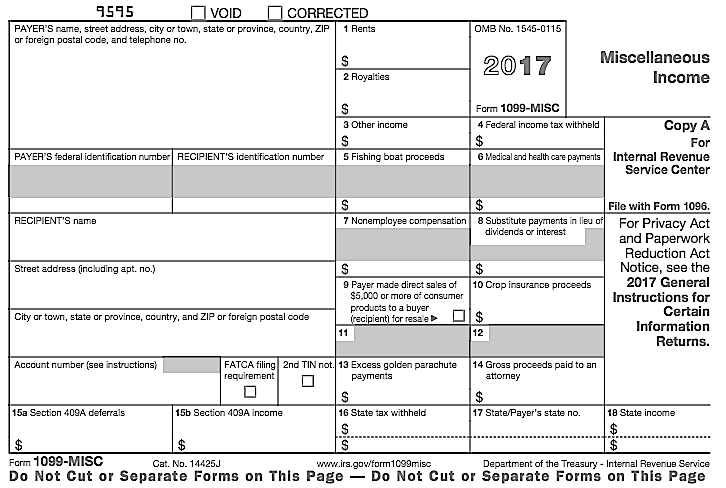

Beginning 2020 IRS Requires 1099-NEC Instead of 1099-MISC

What is Form 1099-NEC? Starting with the 2020 tax year, the IRS requires businesses to use the new Form 1099-NEC to report nonemployee compensation – not Form 1099-MISC, which was previously used. Filing Taxes With a 1099-NEC If you are self-employed and receiving any type of 1099 forms, you should be using a tax preparation...

Tax Cuts and Jobs Act (TCJA) Made Changes to Business Deductions

As our Ken-Mar Tax clients know, we pride ourselves on maximizing tax deductions for the self-employed – which is why so many of our customers are real estate agents, small business owners and W-2ed employees with “side-hustles” like ride-sharing with Uber or Lyft, selling hand-made crafts on etsy or re-selling on Facebook Marketplace, Poshmark or...Continue reading

IRS 5-Year Improvement Plan; Enrolled Agents or Cleveland Tax Attorneys?

Enrolled Agents of IRS Cleveland Given Details of 5-Year Plan Recently the enrolled agents of Ken-Mar Tax have been notified of the large-scale effort of the Internal Revenue Service (IRS) to increase their workforce and update their technology in order to help enforce the implementation of new tax laws. A recent article in the Government...Continue reading

File Back Taxes for Ohio Now – Tax Forgiveness

Do you owe back taxes in Ohio? Now is the time to file all Ohio back taxes and receive major savings during the Ohio Tax Amnesty period of January 1, 2018 – February 15, 2018. Whether you’re self-employed, a small business or file an individual tax return, you may apply for Ohio tax amnesty which...

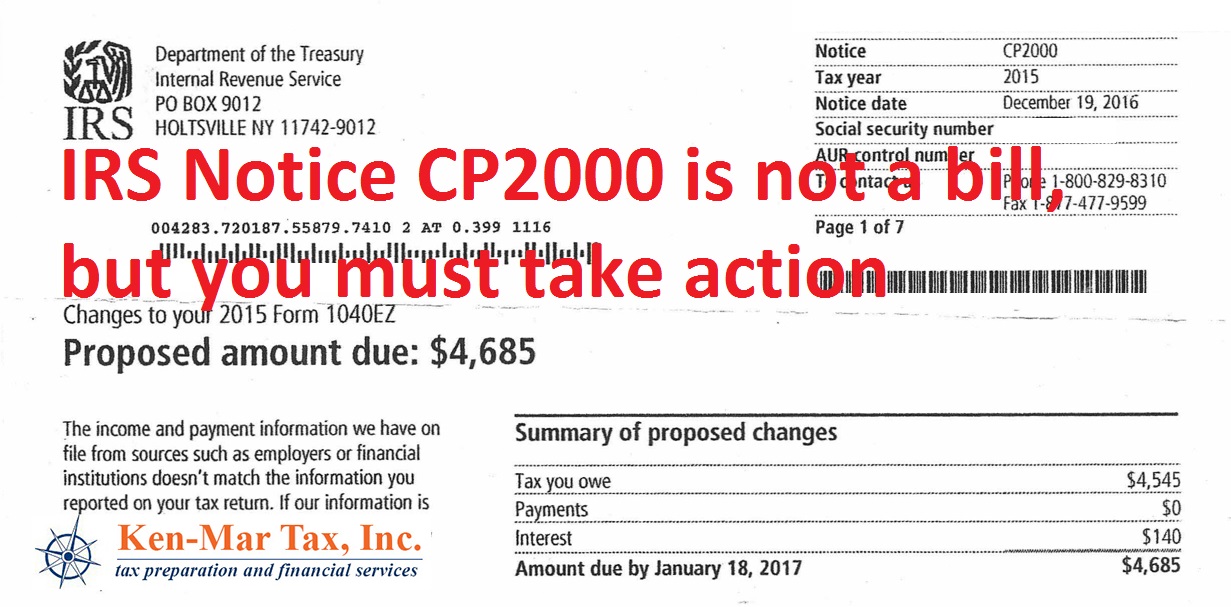

Cleveland IRS Tax Help: IRS Notice CP2000

As Cleveland tax preparation specialists we spend most of our time after “tax season” (the time period between Jan 14th and April 15th of each year) focusing on new clients that come to us with IRS, Ohio and local back taxes, tax resolution issues that can include wage garnishments and tax penalties and helping sort...Continue reading

1099 Forms – How to File if You Get One and When You Should Be Giving Them

There are many conflicting opinions you’ll read on line and get from CPAs and tax preparation specialists about when to file a 1099 as a business and how to prepare your taxes as an individual receiving a 1099 Form. As an enrolled agent Ken Weinberg attends hours of continuing education regarding the tax code, is...Continue reading

Tax Services Cleveland: Tax Preparation Coupon

Has time gotten away from you? Have you not filed your income taxes for 2016? Maybe you were too busy in January and February enjoying some of the most unseasonably warm weather for our Cleveland area. Or maybe you’re still waiting on some tax documents. Whatever the reason, the tax filing deadline this year is...Continue reading