As you consider shutting down your sole proprietorship or your single-member LLC treated as a sole proprietorship for tax purposes, it’s crucial to understand the tax implications of this decision. Here’s an overview of key points you need to consider. Sole Proprietorship Asset Sale Tax Implications When you sell a sole proprietorship, you sell its...Continue reading

Tag: Enrolled Agent

Last-Minute Purchases to Maximize 2023 Vehicle Tax Deductions

Looking to maximize your vehicle tax deductions for 2023 and wondering if there's still time? - Do you need a replacement business car, SUV, van, or pickup truck? - Do you need tax deductions this year? - Do you need a tax credit to offset what you owe to the IRS? 2023 Tax Credits /...

How to Get IRS Penalties Waived?

Are you interested in learning how to get your IRS tax penalties waived? Are you wondering if the State of Ohio waives tax penalties? What about RITA, our local tax collection agency serving most of the Northeast Ohio region? If you (or your corporation) file your tax return late or fail to pay your taxes...Continue reading

Work From Home Tax Benefits in Cleveland Area

Do you live in the Cleveland area and work from home? If so, you should be aware of the many work from home tax benefits. Aside from potential home office deductions and other write-offs routinely claimed by the self-employed (see "Tax Reduction Strategies for the Self-Employed"), a huge benefit could depend on comparing the Municipal...Continue reading

IRS Refunds Seriously Backlogged

Millions of taxpayers are still waiting for refunds and/or struggling to understand IRS notices saying their refund amounts have been adjusted. And the IRS expects to receive another 4 million returns for tax year 2020 by the October 15th tax filing extension deadline. – Forbes October 10, 2021 Why are tax refunds so late? Why...

Coronavirus Postpones Tax Deadlines & Provides IRS Collection Relief

Do you have IRS back taxes from years passed? Were you already dreading the idea of doing your 2019 taxes because of your federal tax liability? Are you in an existing installment agreement with the IRS for unpaid taxes or have a pending Offers in Compromise (OIC)? The IRS announced a new series of relief...Continue reading

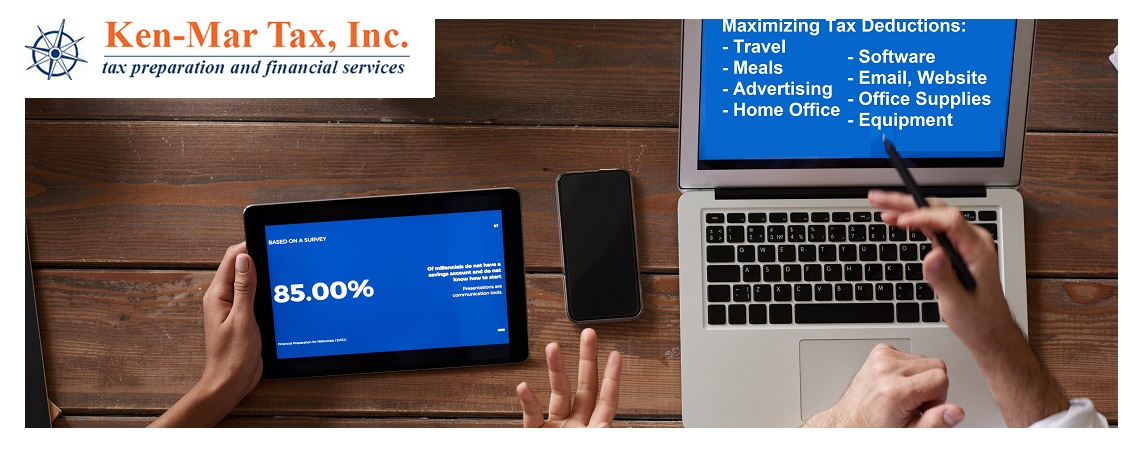

Tax Cuts and Jobs Act (TCJA) Made Changes to Business Deductions

As our Ken-Mar Tax clients know, we pride ourselves on maximizing tax deductions for the self-employed – which is why so many of our customers are real estate agents, small business owners and W-2ed employees with “side-hustles” like ride-sharing with Uber or Lyft, selling hand-made crafts on etsy or re-selling on Facebook Marketplace, Poshmark or...Continue reading

IRS 5-Year Improvement Plan; Enrolled Agents or Cleveland Tax Attorneys?

Enrolled Agents of IRS Cleveland Given Details of 5-Year Plan Recently the enrolled agents of Ken-Mar Tax have been notified of the large-scale effort of the Internal Revenue Service (IRS) to increase their workforce and update their technology in order to help enforce the implementation of new tax laws. A recent article in the Government...Continue reading

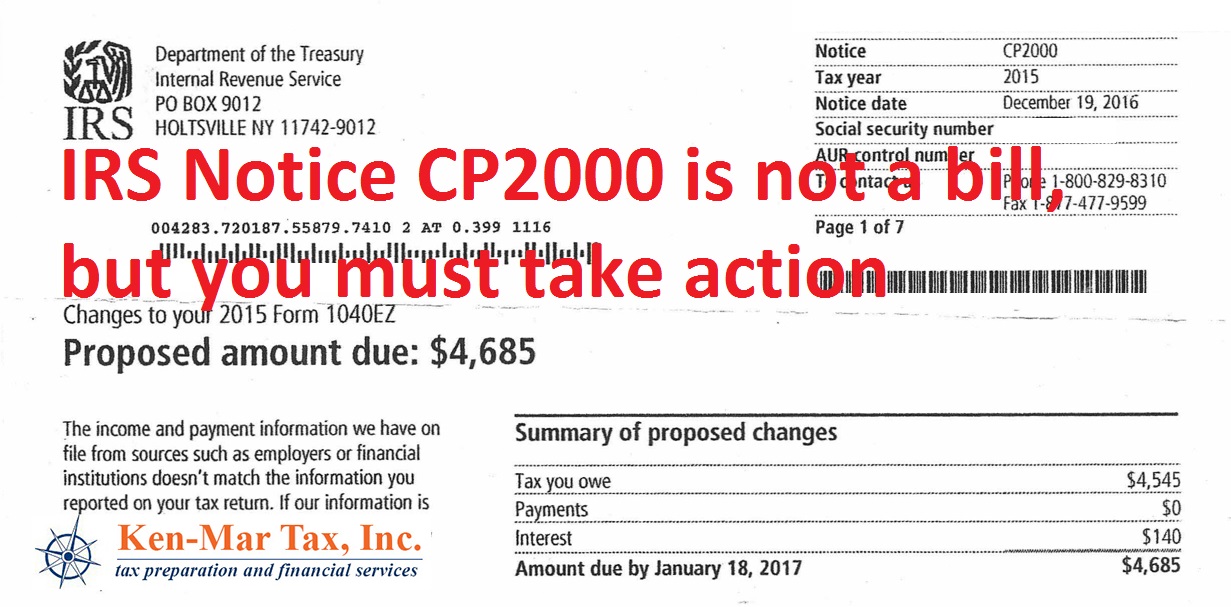

Cleveland IRS Tax Help: IRS Notice CP2000

As Cleveland tax preparation specialists we spend most of our time after “tax season” (the time period between Jan 14th and April 15th of each year) focusing on new clients that come to us with IRS, Ohio and local back taxes, tax resolution issues that can include wage garnishments and tax penalties and helping sort...Continue reading