For over 20 years, the IRS has issued an annual Dirty Dozen list identifying tax scams and avoidance schemes. This year’s list includes everything from employee retention credit claims to the use of fake charities. Before you invest your hard-earned money in these or other highly promoted tax schemes, you should check the IRS Dirty...Continue reading

Tag: tax strategies

Last-Minute Purchases to Maximize 2023 Vehicle Tax Deductions

Looking to maximize your vehicle tax deductions for 2023 and wondering if there's still time? - Do you need a replacement business car, SUV, van, or pickup truck? - Do you need tax deductions this year? - Do you need a tax credit to offset what you owe to the IRS? 2023 Tax Credits /...

Last-Minute: 2023 Tax Strategies for Marriage, Kids, and Family

It's not too late to consider 2023 tax strategies. Are you thinking of getting married or divorced? If so, consider December 31, 2023, in your tax planning. Here’s another planning question: Do you give money to family or friends (other than your children, who are subject to the kiddie tax)? If so, you need to consider...Continue reading

Will Your Home Office Deduction Pass the Muster in an IRS Audit or Raise Red Flags?

With more people working from home, one has to wonder if the home-office deductions on tax returns are out of control or warranted. Will the IRS be scrutinizing home office deductions and what do they look for. In short, will your home office deduction pass in an IRS audit or will it raise red flags?...Continue reading

When to File Form 8275 to Avoid Penalties

Form 8275 is filed to disclose all types of tax positions. When you're considering taking an aggressive position on your tax return that could result in a substantial tax reduction, but you're worried about having to pay a penalty, talk with Ken-Mar Tax for a free consultation. As an Enrolled Agent, Ken Weinberg is up-to-date...Continue reading

Home-Office Deductions for Orthodontists

Q&A: Home-Office Deduction for Orthodontist Question: Bob, an orthodontist, wants to claim a home-office deduction. His employees and contractors do the billing and accounting for his practice. Bob and his wife (who is an employee) do payroll once a month in the home office. Bob’s primary use of the home office is preparing treatment plans...Continue reading

Do I Need to Pay Self-Employment Tax on Airbnb Rental Income?

In Chief Counsel Advice (CCA) 202151005, the IRS opined on this issue. But before we get to what the IRS said, understand that the CCA’s conclusions cannot be cited as precedent or authority by others, such as you or your tax professional. Even so, we always consider what the CCA says as semi-useful information, so here’s some...Continue reading

What Qualifies as Regular Use for the Home-Office Deduction?

To deduct an office in the home, you must pass the regular-use test, so what is regular use for the home-office deduction? (Side note: this is a re-post of content created in 2011 and references tax cases from the 70's that laid a foundation for determining how to define "regular use" for the home office...Continue reading

When Do I Have to Pay Self-Employment Taxes?

What Are Self-Employment Taxes? Do I Pay Them? Self-employment taxes are to individual business owners what payroll taxes are to employers and employees. They fund Social Security and Medicare. All individuals with self-employment income must pay self-employment taxes, regardless of their age. When business owners reach retirement age, they’ll be able to collect Social Security...Continue reading

Landlords and Business Owners: New Law Improves Energy Tax Benefits

Landlords and small business owners should know the newly enacted Inflation Reduction Act contains tax credits and depreciation benefits for owners of commercial property and residential rental property. As a Cleveland landlord, or small business owner, if you implement various types of renewable energy improvements, you can qualify for hefty tax credits or deductions. One...Continue reading

Don’t Forget to Request Your RITA Refund

As we posted last month in "Work From Home Tax Benefits in Cleveland Area," you may be entitled to a RITA tax refund. However, your local municipality tax collector, which is what RITA and CCA are - tax collection agencies, are waiting for you to request the refund. RITA refunds will not be automatic. CCA...Continue reading

Work From Home Tax Benefits in Cleveland Area

Do you live in the Cleveland area and work from home? If so, you should be aware of the many work from home tax benefits. Aside from potential home office deductions and other write-offs routinely claimed by the self-employed (see "Tax Reduction Strategies for the Self-Employed"), a huge benefit could depend on comparing the Municipal...Continue reading

2021 Last-Minute Year-End Tax Strategies for Marriage, Kids, and Family

Our specialty at Ken-Mar Tax is to provide our tax preparation clients with tax strategies that will legally reduce their tax obligations. As an IRS enrolled agent, Ken Weinberg keeps up-to-date about all the IRS tax codes in order to use them to your advantage. Tax Strategies for Getting Married, Divorced, Staying Single, Adding Your...Continue reading

Beginning 2020 IRS Requires 1099-NEC Instead of 1099-MISC

What is Form 1099-NEC? Starting with the 2020 tax year, the IRS requires businesses to use the new Form 1099-NEC to report nonemployee compensation – not Form 1099-MISC, which was previously used. Filing Taxes With a 1099-NEC If you are self-employed and receiving any type of 1099 forms, you should be using a tax preparation...

Tax Cuts and Jobs Act (TCJA) Made Changes to Business Deductions

As our Ken-Mar Tax clients know, we pride ourselves on maximizing tax deductions for the self-employed – which is why so many of our customers are real estate agents, small business owners and W-2ed employees with “side-hustles” like ride-sharing with Uber or Lyft, selling hand-made crafts on etsy or re-selling on Facebook Marketplace, Poshmark or...Continue reading

IRS 5-Year Improvement Plan; Enrolled Agents or Cleveland Tax Attorneys?

Enrolled Agents of IRS Cleveland Given Details of 5-Year Plan Recently the enrolled agents of Ken-Mar Tax have been notified of the large-scale effort of the Internal Revenue Service (IRS) to increase their workforce and update their technology in order to help enforce the implementation of new tax laws. A recent article in the Government...Continue reading

Don’t Miss Tax Deductions for Uber, Lyft and other Ride Share Drivers

Have you recently started driving for Uber, Lyft or another ride-share company to pick up some extra cash? Unless you’ve met with Ken Weinberg of Ken-Mar Tax, you’re probably missing out on even more money in tax deductions! Being a tax reduction strategist for the self-employed, Ken specializes in helping people like you who get...Continue reading

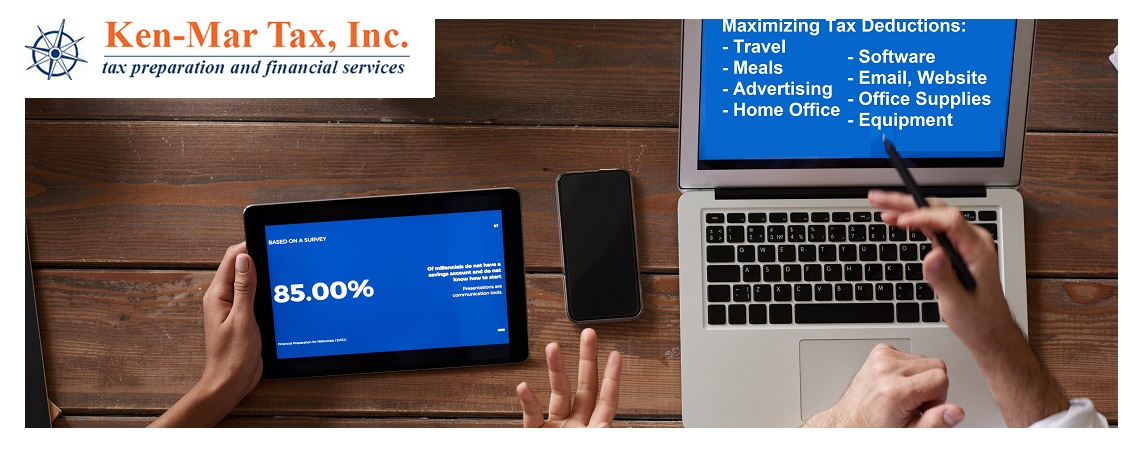

Reduce Taxable Income with these Business Expenses to Claim on Your Taxes

At Ken-Mar Tax we specialize in tax reduction strategies for the self-employed because after decades of studying the tax code, working with the IRS and preparing tax returns for self-employed individuals we realize there are still many business expenses that get forgotten when filing taxes. One thing we do to help our clients is equip...Continue reading

It’s Tax Season. Don’t Fall for these Tax Preparation Myths.

With January’s soon arrival, tax preparation advertising is sure to be in full-swing. Clearly, as tax professionals and enrolled agents for many decades, the team at Ken-Mar tax is especially irritated by the companies and marketing campaigns that project these myths to be true, so we decided it’s time to dispel some of the marketing gimmicks...Continue reading

Last-minute 2015 Tax Strategies for Individual Tax Obligations

With 2015 quickly coming to an end, did you know there is still time to implement some individual tax strategies that can reduce your tax bill? If you’re looking for a few things that can be done to impact your 2015 tax return, we’ve compiled a quick list: 1. Prepay your child’s college tuition. Prepaying college tuition...Continue reading